Planning & budgeting

Saving & investing

KiwiSaver

Tackling debt

Protecting wealth

Retirement

Home buying

Life events

Setting goals

Money tracking

Plan your spending with a budget

Getting advice

Studying

Get better with money

What pūtea beliefs do you have?

How to build up your emergency savings to cover unexpected costs

How to save your money

How to start investing

Find a financial adviser to help you invest

Your investment profile

Compound interest

Net worth

Types of investments

Term deposits

Bonds

Investment funds

Shares

Property investment

How KiwiSaver works and why it's worth joining

How to pick the right KiwiSaver fund

Make the most of KiwiSaver and grow your balance

How KiwiSaver can help you get into your first home

Applying for a KiwiSaver hardship withdrawal

How to use buy now pay later

What you really need to know before you use credit

How to get out of debt quickly

Credit reports

Know your rights

Pros and cons of debt consolidation

Credit cards

Car loans

Personal loans

Hire purchase

Student loans

Getting a fine

What happens if I start to struggle with moni?

How to protect yourself from fraud and being scammed

About insurance

Insurance types

Insuring ourselves

Wills

Enduring powers of attorney

Family trusts

Insuring our homes

Losing a partner

Redundancy

Serious diagnosis

How to cope with the aftermath of fraud

Separation

About NZ Super – how much is it?

When you’re thinking of living in a retirement village

How to plan, save and invest for retirement

Manage your money in retirement

Find housing options in retirement

Four approaches to spending in retirement

Planning & budgeting

Saving & investing

How to build up your emergency savings to cover unexpected costs

How to save your money

How to start investing

Find a financial adviser to help you invest

Your investment profile

Compound interest

Net worth

Types of investments

Term deposits

Bonds

Investment funds

Shares

Property investment

View all

KiwiSaver

Tackling debt

How to use buy now pay later

What you really need to know before you use credit

How to get out of debt quickly

Credit reports

Know your rights

Pros and cons of debt consolidation

Credit cards

Car loans

Personal loans

Hire purchase

Student loans

Getting a fine

What happens if I start to struggle with moni?

View all

Protecting wealth

Retirement

Home buying

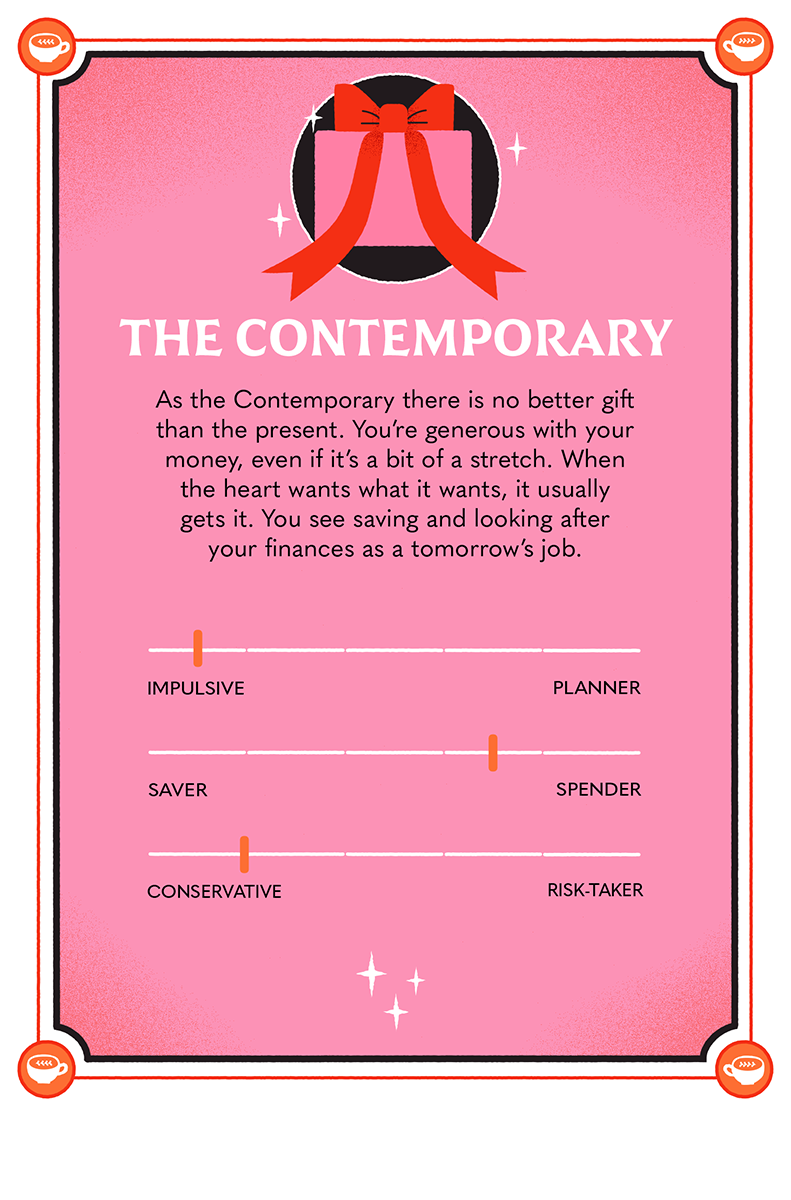

You’re generous with your money, even if it’s a bit of a stretch. When the heart wants what it wants, it usually gets it.

There is no better gift than the present. You’re generous with your money, even if it’s a bit of a stretch. When the heart wants what it wants, it usually gets it. You see saving and looking after your finances as tomorrow’s job.

Ignorance is bliss. What you don’t know (about your bank account) won’t hurt you.

Whether spending to celebrate, or spending to heal, your purchases are swayed more by impulse than intuition.

There’s no time like the present. For you, tomorrow’s bills end up being eclipsed by today's thrills.

You are the product of the present moment, and when it comes to your money, you don’t place too much importance on it. Your generous spirit can be both a blessing and a curse, as you are prone to spending beyond your means, which can be tough to balance with your financial responsibilities. While you may dislike financial matters and lack confidence in your abilities to manage money, you hold the power to shape your financial future. By expanding your financial toolkit through the automation of processes that will take care of themselves in the background, you can free yourself up to focus more on what you love.

Build your resilience with a starter emergency fund, or a more robust safety net that will get you through it all.

No fault in being generous, but it’s tough to give what you don’t always have. Work even more giving into your budget.

You're only as good as your system – automate your savings and get things growing in the background.

Tool

Budgets are simple plans for your spending and saving, and this tool lets you easily chart your incomings and outgoings to get the most out of your money.

Tool

Are you saving a bit at a time, or for a goal you have? This tool lets you see how quickly your savings add up, especially with the power of compound interest over time.

Guide

Budgets help us plan where our money should be going, but it’s also important to track where our money actually goes. Getting a handle on how our money comes in and goes out is really the next step to getting our finances sorted and getting ahead.

Guide

A budget (or money plan) is really just a simple plan for your spending.

Guide

One of the best habits we can get into is “paying ourselves first” and making it automatic. The more we get into saving, the easier it is to achieve our goals and get ahead.

Guide

Debt comes in many forms – credit cards, hire purchase, car loans, personal loans, mortgages, student loans. There's no shortage of people out there wanting to lend us money!

Blog

Many of us struggle with buying things we don’t need. Understanding what's driving that can help us get our money under control.

Blog

To understand why we make the money choices we do, it helps to start with our childhoods.

Blog

Our money tendencies show why we handle money the way we do. See which way you lean.

Blog

What counts most is setting aside money that moves us forward financially. Does your saving do that?

Use verification code from your authenticator app. How to use authenticator apps.

Code is invalid. Please try again

Don't have an account? Sign up

Or log in with our social media platforms

A free account gives you your very own space where you can save your tools and track your progress as you get ahead.

Or sign up using Google: