Budgeting

KiwiSaver is a voluntary savings scheme set up by the government to help New Zealanders to save for their retirement.

It's an easy and affordable way to save and invest for our retirement years. Most of us can benefit from joining KiwiSaver, if we haven’t already.

Employees can choose to contribute 3%, 4%, 6%, 8% or 10% of your gross (before tax) wage or salary to our KiwiSaver account.

Employers are required to contribute close to 3% of your gross salary if you contribute.

There’s an annual government contribution as well, even if you're not an employee – as much as $521 each year until you're 65.

Your savings are invested on your behalf by the KiwiSaver provider of your choice. If you don’t choose a provider, Inland Revenue will assign you to a default KiwiSaver fund that can be a good solution for you.

A KiwiSaver fund is more than just a savings account. It's similar to what we call a managed fund. Your fund manager invests your KiwiSaver savings on your behalf, which means your savings also earn returns over time.

Your KiwiSaver grows with:

When buying your first home you may be able to make a one-off withdrawal of most of your KiwiSaver savings – as long as you’ve been a KiwiSaver member for at least three years. You also may even qualify if you have owned property previously.

Our KiwiSaver calculator can help you find out how much you're on track to save for your first home.

Visit the Kāinga Ora website for more information on using KiwiSaver for a first home.

If using KiwiSaver to save for retirement, you can’t touch your money until the age you get New Zealand Superannuation (NZ Super) which is currently 65. Note that KiwiSaver is open to those over 65 to join as well.

Find out how much you're on track to save for your retirement using the KiwiSaver calculator.

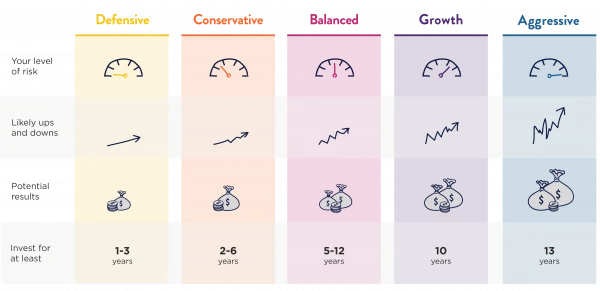

We’ve grouped the hundreds of KiwiSaver funds into five types to make things easier. Once you find which is right for you, it’s much simpler to find a fund of that type.

Each fund holds a mix of investments, and which type they fit into is based on how much of the more risky stuff, like shares and commercial property, is in the mix. The more risk you take on, the more potential you have for better results, but your balance will have more ups and downs along the way.

Depending on how long you are investing for, and your attitude towards the ups and downs that can happen with investing, one type of fund will work particularly well for your situation.

There are a number of private KiwiSaver providers, like big banks or smaller niche players, who manage the schemes.

Not sure who yours is? It's not hard to find out.

Contact Inland Revenue and if you’re a member, they will have your details on file. Call 0800 KIWISAVER or log in to My KiwiSaver to find out your provider.

You can choose the KiwiSaver scheme your savings are invested with or let your employer or the government choose one for you.

KiwiSaver schemes are run by ‘providers’ like banks and investment companies and typically have a number of funds to choose from.

Each fund has a different mix of things it invests in – such as bank deposits, bonds, shares and property. Find out which type of fund is right for you in this guide on How to pick your KiwiSaver fund.

It’s easy to change funds in KiwiSaver, but it’s not always the best idea. Before switching, compare fees, fund performance and the services offered by providers using the KiwiSaver fund finder. Your reasons for changing KiwiSaver funds should be based on building your long-term balance.

If you'd like some professional advice, speak to a financial adviser who specialises in KiwiSaver.

When you're ready to make the big switch, get in touch with your new KiwiSaver fund provider – they'll help you through the steps to move your savings over to the new fund.

After you reach 65, you become eligible to take all or some of your contributions, your employer’s contributions, the government's contributions, plus returns. In short, the whole thing.

How fast you open the tap is up to you: keep it off for now and leave your money invested in KiwiSaver, open it slightly to drip-feed some income, or open it right up to spend or invest the entire amount (although you may not be able to rejoin KiwiSaver if you draw it down entirely).

There’s no rush – you can leave your money where it is while you work through all the issues and decide. For example, if you want to make regular withdrawals, there may be a minimum amount required or some fees.

It may be worth talking with a financial adviser about your financial needs and risks, and work out the best course of action to reach your goals. Find out how to find a financial adviser in our guide.

Contact your KiwiSaver provider directly to find out what’s involved and to make arrangements.

You can still keep your KiwiSaver account open and growing. Your employer can choose to keep contributing, although they don’t have to. The government will no longer pay its contribution though, since you're typically eligible for NZ Super.

The question of KiwiSaver is less ‘why’ and more ‘why not?’ – because of the benefits it offers.

To be able to join KiwiSaver you don’t have to be employed, but you do have to be:

A New Zealand citizen, or entitled to live in New Zealand indefinitely.

Living or normally living in New Zealand.

Find out more about who can and can't join KiwiSaver on the Inland Revenue KiwiSaver website.

There are three ways to join KiwiSaver:

Self-employed? Not currently working? Not a problem – just contact a KiwiSaver provider to sign up and arrange a regular contribution amount. For a list of KiwiSaver providers, see the Inland Revenue KiwiSaver website.

Also, find out more about how to join KiwiSaver on the Inland Revenue KiwiSaver website.

No, not necessarily. In fact, from 1 December, there will be more advantages to staying in one than there were before: they'll exclude investments in fossil fuels and illegal weapons, cost significantly less than other funds, have a balanced investment mix (instead of conservative), and offer a high level of service to their members. But since balanced funds are not right for everyone, default funds won't be either. To make your choice of whether to be in a default fund, first find out which type of KiwiSaver fund will work best for you.

KiwiSaver is not guaranteed by the government. It is, however, administered by Inland Revenue, which helps make sure it works properly, and overseen by the Financial Markets Authority, which makes sure KiwiSaver companies behave themselves and do right by you. It's important to remember that KiwiSaver providers are private companies, like any bank we use. Here are more KiwiSaver facts.

No, it’s easy as – about the same as switching your mobile or power provider, actually. You let your new company know you want to move to them, and they do all the work behind the scenes. There are two ways of switching with KiwiSaver: staying with your provider but moving to one of their other funds, or moving to a new provider. There are good reasons to switch, such as when you're getting closer to the time you plan to start spending your KiwiSaver money, on a first home or in retirement. But there are also bad reasons to switch, such as because you heard about some other fund doing better than yours. Here's why.

No. When you take out your KiwiSaver money, either for a first home, financial hardship, or to use to live on in retirement, that money is tax-free. Your KiwiSaver contributions are made after your income has been taxed, and the gains from your investments that you own in KiwiSaver are taxed as well. But when you withdraw for a first home or retirement at age 65, there is no tax to pay. It's your money to use. To withdraw your KiwiSaver money, contact your provider directly.

There are three prescribed investor rates (PIR) in KiwiSaver: 10.5%, 17.5%, or 28%. It helps to make sure your rate is correct so you're not paying more tax than you should be. If your income is sometimes or always less than $48,000 each year, you may be paying too much tax in KiwiSaver. It's simple to correct this: just contact your KiwiSaver provider directly and let them know.

Your KiwiSaver money is much like everything else you own – when you die it becomes part of your estate and is distributed according to the instructions you leave in your will. It's important to have a will drawn up just in case. Without a will the government will use a set formula to split up your assets – and this might not be what you would have wanted. To make sure your wishes are followed, particularly with your KiwiSaver, here's more about wills.

If automatically enrolled, you can ‘opt out’ (leave KiwiSaver), but only between 2 and 8 weeks of starting a job. Once you join you have to contribute for at least 12 months. (If you’re 18 or younger and have been incorrectly enrolled, you can still opt out through Inland Revenue.)

You can choose to ‘opt in’ (join KiwiSaver) at any time – although once you do, you can't opt out –either through your employer or through a KiwiSaver provider.

Don’t know where to start? Our 6 steps will help you to take control of your money.

Head to the 6 steps

Use verification code from your authenticator app. How to use authenticator apps.

Don't have an account? Sign up

Or log in with our social media platforms

A Sorted account gives you a personal dashboard where you can save your tools, track your progress and you'll also receive helpful money tips and guidance straight to your inbox.

Or sign up with our social media platforms