KiwiSaver

Planning & budgeting

Saving & investing

KiwiSaver

Tackling debt

Protecting wealth

Retirement

Home buying

Life events

Setting goals

Money tracking

Plan your spending with a budget

Getting advice

Studying

Get better with money

What pūtea beliefs do you have?

How to save your money

How to start investing

Find a financial adviser to help you invest

Your investment profile

Compound interest

Net worth

Types of investments

Term deposits

Bonds

Investment funds

Shares

Property investment

How KiwiSaver works and why it's worth joining

How to pick the right KiwiSaver fund

Make the most of KiwiSaver and grow your balance

How KiwiSaver can help you get into your first home

Applying for a KiwiSaver hardship withdrawal

How to use buy now pay later

Before borrowing

How to get out of debt quickly

Credit reports

Know your rights

Pros and cons of debt consolidation

Credit cards

Car loans

Personal loans

Hire purchase

Student loans

Getting a fine

What happens if I start to struggle with moni?

How to protect yourself from fraud and being scammed

About insurance

Insurance types

Insuring ourselves

Wills

Enduring powers of attorney

Family trusts

Insuring our homes

Losing a partner

Redundancy

Serious diagnosis

How to cope with the aftermath of fraud

Separation

About NZ Super

This year's NZ Super rates

When you’re thinking of living in a retirement village

How to plan, save and invest for retirement

Manage your money in retirement

Find housing options in retirement

Planning & budgeting

Saving & investing

KiwiSaver

Tackling debt

Protecting wealth

Retirement

Home buying

KiwiSaver

Budgeting

KiwiSaver

Budgeting

Women

Women

Women

Budgeting

Resources

Help with the cost of living

Just wondering

In need of financial help

Booklets

Glossary

Videos

Blogs

View all

17 August 2022

Reading time: 6 minutes

Posted

by

Tom Hartmann

, 0 Comments

Looking back at the first half of the year, investing in KiwiSaver turned bumpy, with most of us seeing our balances fall.

For NZ shares it was the worst six months in 50 years, and then from the end of June it’s been the best month in 80 years… it’s hard to know what to think!

We’re told not to worry, but it’s challenging, since our brains are hardwired to avoid anything that feels like a loss. Here’s how to ride the ups and downs of being an investor in KiwiSaver.

Investments go up and down, since they are worth more or less on the market at any given time. Think of them like owning some slices of a few oranges in a grocery. At times oranges will be selling for more, at times less, and your segments go up and down in value with them.

Remember, your KiwiSaver balance is not what you have, it’s what your investments are worth at a given time.

The drops we see are just paper losses to be sure. No actual money is being lost – unless we sell our investments, switch funds and make those losses real. That’s when we truly lose money, and we miss out on any future recovery.

Once again, the advice of the experts is to keep calm and carry on – provided you are in the right type of fund for you. Once you’ve set your course (and decided to get on this rollercoaster), you can sit tight and even enjoy the ride a bit. It’s terrifying, but full of potential.

It also helps to remember that if you keep contributing and buying into KiwiSaver, lower prices in the markets mean that you can buy more assets. They’re on sale after all. (Okay, so maybe not so terrifying.)

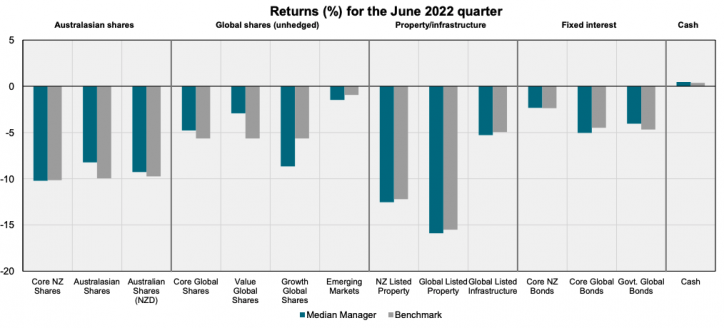

For KiwiSaver investing in the first half of 2022, not much seemed to work. Here’s a striking chart from our number crunchers that shows shares, bonds (sometimes called ‘fixed interest’) and property. Practically everything was falling below the line and showing negative returns, with only cash at the end continuing to pay a bit of interest:

The thing is, all of those bars typically would be above the line!

What’s unusual was that both bonds and shares fell at the same time (although you can see that for bonds not as much, since they are less risky assets). In the past they would typically head in opposite directions and balance each other out (which is why ‘balanced’ funds were given their name, holding half and half of each to get more of a steady ride).

This can seem odd, since many investors chose conservative funds – which hold mostly bonds – expecting that they would never go down. But they can at times, and that was the case in the first half of the year.

All the talk these days seems to be about whether we are in a recession, which is technically when economic activity shrinks for two quarters in a row. It typically gets declared after the fact, so we may be in one already but just don’t know it.

It’s important to remember that share prices are forward looking – so in this case, they are already being priced as if there will be a recession. So even if we go into a recession, it doesn’t necessarily mean that prices will fall further at all. Investors have already taken it into account and adjusted their expectations.

It would take some other bad news for things to drop further. If there isn’t anything worse ahead, we can expect this rollercoaster will stop diving and we will stop losing money on paper and start growing our money once again.

This graph shows how close to 3,000 shares from 48 countries around the world have fared over the last 22 years. You can see the dotted trend line heading upwards.

There have been two huge falls due to the dot com bubble and the Great Financial Crisis, and you can see how things have been falling lately as well. But we are still well above the line.

Who knows where we’re headed? (Beware of those who claim to know with certainty.)

Much of share prices depend not only on the data, but how investors feel about that data. Despite all the ups and downs from the first quarters of 2022, there’s no reason not to be optimistic for the decades to come.

As we mentioned above, what can give you peace of mind is having your strategy set… which lets you forget all about it. If you are looking for good results over the medium and longer term, you can ride out the ups and downs – as long as you’ve got your risk settings right.

This means you have made an active choice of which type of fund is right for you, and you choose your KiwiSaver fund from that type. It’s simple with our KiwiSaver fund finder.

Then, once you’re on the ride, no point in trying to hop off midway!

A final note about the government’s contribution to our KiwiSaver, which you may remember is 50 cents for every dollar we put in, which means you can get up to $521 every single year.

To get the maximum, it comes to $20 a week throughout the year (which ends in June). Now is a great time of the year to set up an automatic payment each time you’re paid.

The sooner you do, the more painless it is, since leaving it to the last minute in June feels expensive and hurts more. When it rolls around, you won’t find yourself short the $1043 you need – you’ll have that money tucked away, all ready to get the government boost of $521.

That extra money is bound to help our balances grow toward the future, no matter how steep the rollercoaster is in the short term.

Hold on tightly, and try to enjoy the ride if you can.

5 steps to get your $521

1 Comment

Who’s teaching your daughter (or niece, or granddaughter) about money?

1 Comment

My Money Sorted: Hilary Barry

2 Comments

My Money Sorted: Ben

3 Comments

My Money Sorted: Daniel

1 Comment

8 ways to hack Christmas when you’re stretching the budget

6 Comments

Use verification code from your authenticator app. How to use authenticator apps.

Code is invalid. Please try again

Don't have an account? Sign up

Or log in with our social media platforms

A Sorted account gives you a personal dashboard where you can save your tools, track your progress and you'll also receive helpful money tips and guidance straight to your inbox.

Comments (0)

Comments

No one has commented on this page yet.

RSS feed for comments on this page | RSS feed for all comments