Planning & budgeting

Saving & investing

KiwiSaver

Tackling debt

Protecting wealth

Retirement

Home buying

Life events

Setting goals

Money tracking

Plan your spending with a budget

Getting advice

Studying

Get better with money

What pūtea beliefs do you have?

How to build up your emergency savings to cover unexpected costs

How to save your money

How to start investing

Find a financial adviser to help you invest

Your investment profile

Compound interest

Net worth

Types of investments

Term deposits

Bonds

Investment funds

Shares

Property investment

How KiwiSaver works and why it's worth joining

How to pick the right KiwiSaver fund

Make the most of KiwiSaver and grow your balance

How KiwiSaver can help you get into your first home

Applying for a KiwiSaver hardship withdrawal

How to use buy now pay later

What you really need to know before you use credit

How to get out of debt quickly

Credit reports

Know your rights

Pros and cons of debt consolidation

Credit cards

Car loans

Personal loans

Hire purchase

Student loans

Getting a fine

What happens if I start to struggle with moni?

How to protect yourself from fraud and being scammed

About insurance

Insurance types

Insuring ourselves

Wills

Enduring powers of attorney

Family trusts

Insuring our homes

Losing a partner

Redundancy

Serious diagnosis

How to cope with the aftermath of fraud

Separation

About NZ Super

This year's NZ Super rates

When you’re thinking of living in a retirement village

How to plan, save and invest for retirement

Manage your money in retirement

Find housing options in retirement

Four approaches to spending in retirement

Planning & budgeting

Saving & investing

How to build up your emergency savings to cover unexpected costs

How to save your money

How to start investing

Find a financial adviser to help you invest

Your investment profile

Compound interest

Net worth

Types of investments

Term deposits

Bonds

Investment funds

Shares

Property investment

View all

KiwiSaver

Tackling debt

How to use buy now pay later

What you really need to know before you use credit

How to get out of debt quickly

Credit reports

Know your rights

Pros and cons of debt consolidation

Credit cards

Car loans

Personal loans

Hire purchase

Student loans

Getting a fine

What happens if I start to struggle with moni?

View all

Protecting wealth

Retirement

Home buying

Net worth is a relatively quick and easy calculation to make, and it’s a valuable way to track your financial progress and see if you’re really getting ahead. So what is net worth and how do you work out your net worth?

Net worth is an indicator of your financial health. Your net worth is the difference between what you own and what you owe. How much would you have in hand if you sold everything you had today and paid off all your debt?

Knowing exactly where you stand means you’re better equipped to make informed decisions to reach your financial goals. When you know you’re on the right track you can give yourself the space to enjoy life the way you want to – that might mean a classic car or a big overseas trip.

Building up your net worth means you have something to live off when you stop working. And if leaving a legacy to the kids is a priority, this is the number to keep an eye on.

Use the Sorted personal net worth calculator to calculate your net worth – just plug in the numbers and sit back.

First, list all of your assets and their current values. That includes the balance in your bank accounts, any investments you have including KiwiSaver, your home or any property you own, and any other significant material possessions (for example, a car).

Figuring out the value of the ‘liquid’ assets like the money in your accounts is fairly easy, but with ‘fixed’ assets – items that would need to be sold in order to convert them to cash – you may need to take an educated guess at what they’re worth.

Next, list all of your debts. That includes student loans, credit cards, car loans, personal loans, hire purchase loans, mortgages, etc.

Subtract the amount of debt from the amount of assets, and voila! That’s your net worth.

If that number is greater than zero your net worth is ‘positive’ and it means you own more than you owe. If it’s less than zero your net worth is ‘negative’ and means your debts outweigh your assets.

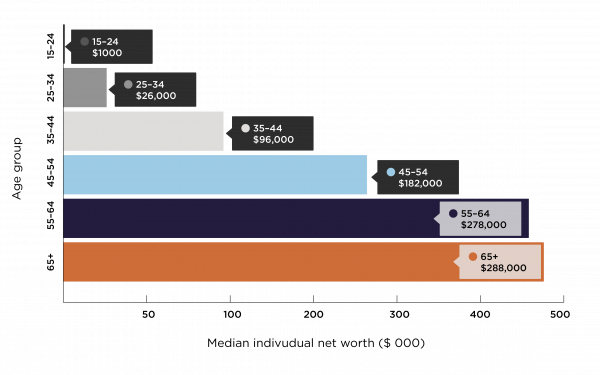

Net worth generally increases with age as people build wealth over a lifetime. Often we start out with a negative net worth – student loans in particular can put us in the red, and in New Zealand they account for 70 percent of young people’s debt. On the other hand, older people have generally accumulated retirement savings over the years and often own a home outright.

According to Statistics NZ, the median New Zealand household net worth was $289,000 in 2014/15 and the median net worth of individuals was $87,000. (Fun fact: Graeme Hart, the richest New Zealander, clocks in at $7 billion; Bill Gates, the richest person in the world, is worth $75 billion.)

But let’s look at how this breaks down in more detail. We’ve put together an overview of New Zealanders’ average net worth by age, based on figures from Statistics NZ.

Getting ahead financially means making moves to increase your net worth. That can mean paying off debt, or saving/investing more – or both! Use the Sorted debt calculator and savings calculator to see how to get ahead faster.

When making any decision that involves money, it can help to step back and reflect on whether that choice will increase or decrease your overall net worth. Are you buying something without any lasting value, or something that will create and grow value for you in the long run? The best financial moves always boost your net worth.

Finally, it’s worth reiterating: net worth and self-worth are different beasts.

Use verification code from your authenticator app. How to use authenticator apps.

Code is invalid. Please try again

Don't have an account? Sign up

Or log in with our social media platforms

A free account gives you your very own space where you can save your tools and track your progress as you get ahead.

Or sign up using Google:

Comments (3)

Comments

23 March 22

vicktoria

veri nice

25 April 19

Gareth

Hey guys, Sorry but this artcile is quite sloppy.

When you buy a property or any asset via a debt instrument (i.e. Home Loan), theoretically your Net position, specifically in relation to the Home, will be 'Current Home Value' + 'Value of Capital paid off (i.e. excluding payments going to interest)' - 'Original Loan Value'.

You could go deeper and also subtract what the total interest you will be expected to pay over the term of the Loan if you percieve this as a Fixed Capital loss - mianly if you have no repayment option.

Don't forget to add other assets on here like Cars, Expensive purchases but make sure you are depreciating them on a regular basis - your car losing 5-10% value a year etc.

2 January 19

Brokekiwi

I'd be interested to see what the updated median net worth figures would be from the 2018 census. The figures in this article seem woefully low!

No one has commented on this page yet.

RSS feed for comments on this page | RSS feed for all comments