31 August 2021

Reading time: 6 minutes

Posted by Tom Hartmann,

0 comments

Okay, so you may want to keep your jaw from dropping when you see these…

Tiny percentage points can seem puny in the greater scheme of things. With all that we’ve got going on these days, surely this is just ‘the small stuff’ that we’re not meant to sweat?

Not so with KiwiSaver – especially because we’re investing over such long spans of time.

Here are 7 figures in KiwiSaver you may find hard to believe.

Generally the more you put into your KiwiSaver, the more you are going to get out. But you wouldn’t think that lifting your contributions from 3% to 10% would be as much as $229,000, right?

Depending on our salary, it may be less or even more – but either way, it's big money. And even if you decide to lift your contribution rate to 4% or 6% instead of the full 10%, you'll find it matters hugely.

Use our revamped KiwiSaver calculator to see how much difference it could make to you, for your first home or retirement.

When you’re ready to lift the amount you contribute, you can contact your employer. You can also top-up your account at any time.

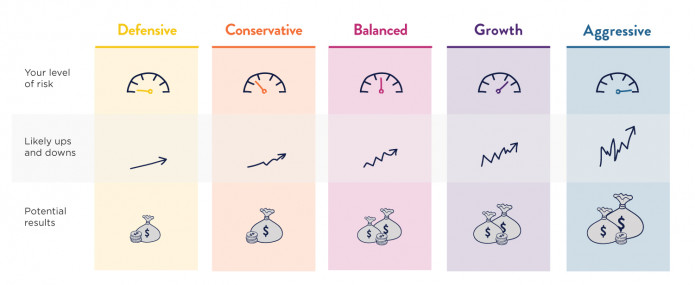

Take a second to read that number again: $135,000! That’s how much more you could have in your KiwiSaver account when you reach 65 just by switching from a conservative to a growth fund.* So the type of fund you’re in matters a lot.

This is particularly important for everyone in KiwiSaver who has not yet made their choice of what fund to be in – many were put in a conservative default fund.

Changing to a growth fund does mean dialling up your risk, so it’s got to be the right move for you. Here’s our guide to help you make sure you’re in the right type of fund.

This one you don’t want to miss out on! If you’re an employee contributing the minimum 3% to your KiwiSaver, your employer matches that money dollar for dollar with another 3%.**

That’s a 100% match for anyone putting in the minimum, and unfortunately a pay cut for anyone who suspends their contributions to KiwiSaver. As we say, it’s one not to miss.

I had to run this number a few times to make sure I was seeing it correctly! That’s $46,100 that someone on an average salary would end up paying in fees over their KiwiSaver experience in the most expensive fund.

The cheapest, on the other hand, is $8000 (which still seems a lot of money, but it’s over 47 years). That’s a big difference when you’re saving as much as you can to buy your first home or fund your retirement.

Which would you rather pay? I know where I stand on that! It’s easy to estimate your future fees and compare your fund options in our KiwiSaver fees calculator.

Where can you ever get a 25% return on your money over a year? In KiwiSaver, that’s where! For every dollar you put in, the government adds 25 cents on top – up to a maximum of $260 each year.

That’s $260 more for your future. And over the years, since that government money is invested alongside yours, it can end up being worth as much as an additional $20,000 in your account on average. That might buy us a car (or three!) in our retirement years…

This is an impressive result. Remember how we were saying that a typical KiwiSaver return is 5%? Well, over the past five years, returns have skyrocketed way past that. (Here’s where to see this on Smart Investor.)

Statistically speaking, our expert number crunchers tell us that aggressive funds (which hold mostly shares or commercial property) can rollercoaster anywhere between -12.9% to +22.5% (which puts this 21.46% result at the high end).

When you’re sizing up past returns, look at as long a time period as you can. I came across one fund with a 59.75% return last year – I couldn’t believe it! There are even higher ones if you look around. At that rate, you would double your money every 14 months or so.

But don’t count on that repeating – last year this same fund returned negative results of -25.34%!

Here’s the thing: the more we pay in KiwiSaver fees, the less comes back into our accounts. They’re easy to compare, but they too are shown in tiny percentages. A ‘middle of the road’ fee is 1%. Doesn’t seem like anything, right?

Let’s say you can typically expect 5% return from investing in KiwiSaver. So if you had $10,000 in your account, you’d expect it to become $10,500 after a year.

But with a 1% fee, your return gets chopped down to 4%. So your balance grows to just $10,400 instead, and $100 has gone to fees.

Unfortunately, that feels like 20% (or $100 of that $500 return) has gone missing. I know I’d rather spend that $100 on future beach holidays in retirement instead!

The average KiwiSaver fee is 1.24%. The highest one at the moment, though, is a nosebleed-high 4.37%! You can see the overly expensive funds here on Smart Investor.

Happily, the new default funds coming on 1 December will all be low cost – as low as 0.2%. Those puny percentages sure can pack a punch.

The projections above are for an employee earning an average of $60,000 over a career of 47 years, from age 18 to 65. The salary and all figures here have been adjusted for inflation of 2%, and have also been rounded to the nearest $1,000. The return assumptions for a member with a 28% PIR in a conservative fund is 2.5% pa, and in a growth fund is 4.5% pa.

It’s actually a bit less than 3% because that employer contribution is taxed (ESCT) before it reaches us. But it’s still an unmissable deal for employees.

Use verification code from your authenticator app. How to use authenticator apps.

Don't have an account? Sign up

Or log in with our social media platforms

A free account gives you your very own space where you can save your tools and track your progress as you get ahead.

Or sign up using Google:

Comments (0)

Comments

No one has commented on this page yet.

RSS feed for comments on this page | RSS feed for all comments