Planning & budgeting

Saving & investing

KiwiSaver

Tackling debt

Protecting wealth

Retirement

Home buying

Life events

Setting goals

Money tracking

Plan your spending with a budget

Getting advice

Studying

Get better with money

What pūtea beliefs do you have?

How to build up your emergency savings to cover unexpected costs

How to save your money

How to start investing

Find a financial adviser to help you invest

Your investment profile

Compound interest

Net worth

Types of investments

Term deposits

Bonds

Investment funds

Shares

Property investment

How does KiwiSaver work? Here’s why it’s worth joining

How to pick the right KiwiSaver fund

Make the most of KiwiSaver and grow your balance

How KiwiSaver can help you get into your first home

Applying for a KiwiSaver hardship withdrawal

How to use buy now pay later

What you really need to know before you use credit

How to get out of debt quickly

Credit reports

Know your rights

Pros and cons of debt consolidation

Credit cards

Car loans

Personal loans

Hire purchase

Student loans

Getting a fine

What happens if I start to struggle with moni?

How to build up your emergency savings to cover unexpected costs

Cryptocurrency

How to protect yourself from fraud and being scammed

About insurance

Insurance types

Insuring ourselves

Wills

Enduring powers of attorney

Family trusts

Insuring our homes

Losing a partner

Redundancy

Serious diagnosis

How to cope with the aftermath of fraud

Separation

About NZ Super – how much is it?

When you’re thinking of living in a retirement village

How to plan, save and invest for retirement

Manage your money in retirement

Find housing options in retirement

Four approaches to spending in retirement

Planning & budgeting

Saving & investing

How to build up your emergency savings to cover unexpected costs

How to save your money

How to start investing

Find a financial adviser to help you invest

Your investment profile

Compound interest

Net worth

Types of investments

Term deposits

Bonds

Investment funds

Shares

Property investment

View all

KiwiSaver

Tackling debt

How to use buy now pay later

What you really need to know before you use credit

How to get out of debt quickly

Credit reports

Know your rights

Pros and cons of debt consolidation

Credit cards

Car loans

Personal loans

Hire purchase

Student loans

Getting a fine

What happens if I start to struggle with moni?

View all

Protecting wealth

How to build up your emergency savings to cover unexpected costs

Cryptocurrency

How to protect yourself from fraud and being scammed

About insurance

Insurance types

Insuring ourselves

Wills

Enduring powers of attorney

Family trusts

Insuring our homes

Losing a partner

Redundancy

Serious diagnosis

How to cope with the aftermath of fraud

Separation

View all

Retirement

Home buying

10 July 2017

Reading time: 3 minutes

Posted by Tom Hartmann,

0 comments

Don’t you just love it in the movies when some fearless, flinty-faced hero (or perhaps one with a cape and a mask) grunts that there are “worse things than dying”? It’s typically the all-or-nothing moment as we head towards a white-knuckle finale.

I don’t know about “worse than dying”, but let’s just say we should certainly think about some other risks besides death – it’s not the only thing that can happen to us personally during our working lives. Any of these could derail us from reaching our goals: we might be temporarily disabled (unable to work for up to six months), permanently disabled, or come down with a critical illness. That would obviously make it hard to earn a living and build savings.

It used to be that all people bought (besides protecting their stuff through property, contents and car insurance) was life insurance. We’re way past that now. There’s been a shift to living benefits, and these days it’s increasingly important, for example, to have income protection.

If you’re wondering what insurance you really need, disability and illness are worth looking into. Just how likely are they to happen?

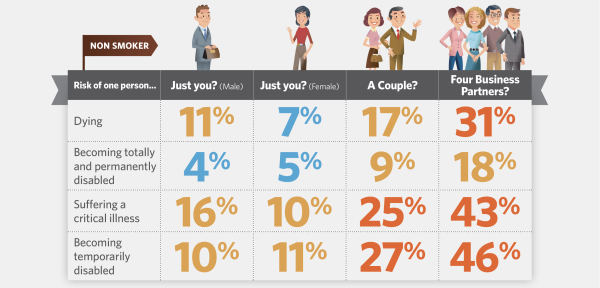

You may be surprised. Have a look at these helpful tables from Quotemonster, a platform insurance advisers use. These stats are for people during their working lives, ages 18 to 65. First, the one for non-smokers:

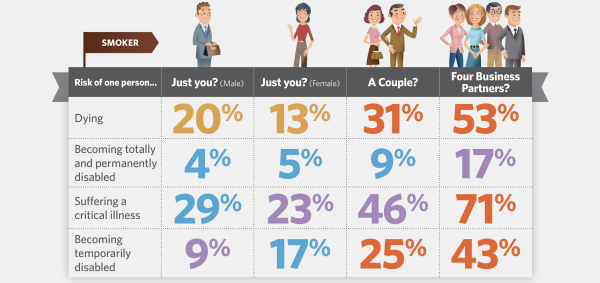

Then, for smokers:

Do these numbers surprise? Some do for me, such as that one in four non-smoking couples will experience a temporary disability (27%) or critical illness (25%) during their working lives. Or that close to half (46%) of business partners will have one in a team of four become permanently disabled. Now that needs insurance.

Remember: risks are anything that might derail us from reaching our goals, especially the long-term ones. As we explore our insurance options online or with insurance advisers, we need to keep the big risks front and centre and make sure we’re covered.

There are far more benefits to the right insurance than just a death benefit. When you’re covered for the main risks, even if you never have to make a claim, there’s valuable peace of mind.

Let’s leave the white-knuckle finales for the movies.

Use verification code from your authenticator app. How to use authenticator apps.

Code is invalid. Please try again

Don't have an account? Sign up

Or log in with our social media platforms

A free account gives you your very own space where you can save your tools and track your progress as you get ahead.

Or sign up using Google:

Comments (0)

Comments

No one has commented on this page yet.

RSS feed for comments on this page | RSS feed for all comments