Planning & budgeting

Saving & investing

KiwiSaver

Tackling debt

Protecting wealth

Retirement

Home buying

Life events

Setting goals

Money tracking

Plan your spending with a budget

Getting advice

Studying

Get better with money

What pūtea beliefs do you have?

How to build up your emergency savings to cover unexpected costs

How to save your money

How to start investing

Find a financial adviser to help you invest

Your investment profile

Compound interest

Net worth

Types of investments

Term deposits

Bonds

Investment funds

Shares

Property investment

How KiwiSaver works and why it's worth joining

How to pick the right KiwiSaver fund

Make the most of KiwiSaver and grow your balance

How KiwiSaver can help you get into your first home

Applying for a KiwiSaver hardship withdrawal

How to use buy now pay later

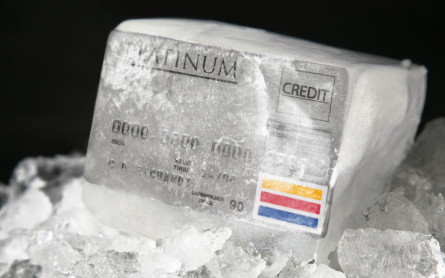

What you really need to know before you use credit

How to get out of debt quickly

Credit reports

Know your rights

Pros and cons of debt consolidation

Credit cards

Car loans

Personal loans

Hire purchase

Student loans

Getting a fine

What happens if I start to struggle with moni?

How to build up your emergency savings to cover unexpected costs

Cryptocurrency

How to protect yourself from fraud and being scammed

About insurance

Insurance types

Insuring ourselves

Wills

Enduring powers of attorney

Family trusts

Insuring our homes

Losing a partner

Redundancy

Serious diagnosis

How to cope with the aftermath of fraud

Separation

About NZ Super – how much is it?

When you’re thinking of living in a retirement village

How to plan, save and invest for retirement

Manage your money in retirement

Find housing options in retirement

Four approaches to spending in retirement

Planning & budgeting

Saving & investing

How to build up your emergency savings to cover unexpected costs

How to save your money

How to start investing

Find a financial adviser to help you invest

Your investment profile

Compound interest

Net worth

Types of investments

Term deposits

Bonds

Investment funds

Shares

Property investment

View all

KiwiSaver

Tackling debt

How to use buy now pay later

What you really need to know before you use credit

How to get out of debt quickly

Credit reports

Know your rights

Pros and cons of debt consolidation

Credit cards

Car loans

Personal loans

Hire purchase

Student loans

Getting a fine

What happens if I start to struggle with moni?

View all

Protecting wealth

How to build up your emergency savings to cover unexpected costs

Cryptocurrency

How to protect yourself from fraud and being scammed

About insurance

Insurance types

Insuring ourselves

Wills

Enduring powers of attorney

Family trusts

Insuring our homes

Losing a partner

Redundancy

Serious diagnosis

How to cope with the aftermath of fraud

Separation

View all

Retirement

Home buying

12 July 2019

Reading time: 3 minutes

Posted by Tom Hartmann,

0 comments

Perhaps it’s because our future selves are strangers to us. We generally find it difficult to picture them, to see them earning and having to make repayments on what we buy today. If saving feels like giving money away to someone we don’t know, why would taking on debt be any different? “Someone else” (read: future you) will pay for it.

What we’re really doing when we borrow is spending “futuredollars” – money that we’ll earn in the years to come. We take yet-to-be cash flow and use it ahead of time.

This may or may not be what’s best for us – no judgement here – but it helps to think of it as spending our own futuredollars to make sure.

Some things will make more sense to borrow for than others. Student borrowing, which is meant to create better options for future income, is an obvious candidate. And since practically none of us walk around with hundreds of thousands in our back pockets for a house, it makes sense to find a home as soon as possible and borrow to live in it. These can be good uses of futuredollars now.

Other things not so much. Many of the things that wind up lingering on our credit cards (holidays, groceries, petrol) would be better paid with cash we hold now.

Why overcommit our future selves when there may be much more pressing uses for money down the line?

All this talk about spending futuredollars is even before we consider all the costs that come with borrowing. These just end up increasing debt’s drag, slowing down our future selves even further.

Interest tops the list, whether it’s at the low end, like mortgages (hovering around 5%), or up higher with credit cards (typically close to 20%). We then go into nosebleed territory with some peer-to-peer loans (30%) and end – hopefully – with the robber barons of the lending landscape: the payday people (some of whose loans charge north of 500% when annualised).

But what doesn’t always get factored in are the myriad fees that come with borrowing too: establishment fees, annual fees... A high-end credit card, for example, can cost $1,200 a year just to use! (The perks better be worth it.)

Whether interest or fees, someone down the line (future you) will need to pay these costs. Sorted’s debt calculator can help you factor them in and calculate how much weight you’re piling on your future self to carry.

What happens if our future selves can’t handle the repayments and the costs? We tend to be optimists, but circumstances change, so it helps to have a plan in place. Mortgage insurance, for example, is fit for this purpose.

On the riskier side of the borrowing spectrum, I am simply gobsmacked by what happens when payments get missed. Defaulting on a payday or car loan, for example, can mean all sorts of added costs get whacked on: default fees, call fees, letter fees, default interest rates.

The load on the borrower’s future only increases, and the loan amount owed can end up ballooning instead of ever coming down. It’s what I call the “tick, tick, boom” effect – when putting things on tick can end up exploding on you.

Which is something I’d never wish on anyone… whether it’s our present or future selves.

Use verification code from your authenticator app. How to use authenticator apps.

Code is invalid. Please try again

Don't have an account? Sign up

Or log in with our social media platforms

A free account gives you your very own space where you can save your tools and track your progress as you get ahead.

Or sign up using Google:

Comments (0)

Comments

No one has commented on this page yet.

RSS feed for comments on this page | RSS feed for all comments