Planning & budgeting

Saving & investing

KiwiSaver

Tackling debt

Protecting wealth

Retirement

Home buying

Life events

Setting goals

Money tracking

Plan your spending with a budget

Getting advice

Studying

Get better with money

What pūtea beliefs do you have?

How to build up your emergency savings to cover unexpected costs

How to save your money

How to start investing

Find a financial adviser to help you invest

Your investment profile

Compound interest

Net worth

Types of investments

Term deposits

Bonds

Investment funds

Shares

Property investment

How KiwiSaver works and why it's worth joining

How to pick the right KiwiSaver fund

Make the most of KiwiSaver and grow your balance

How KiwiSaver can help you get into your first home

Applying for a KiwiSaver hardship withdrawal

How to use buy now pay later

What you really need to know before you use credit

How to get out of debt quickly

Credit reports

Know your rights

Pros and cons of debt consolidation

Credit cards

Car loans

Personal loans

Hire purchase

Student loans

Getting a fine

What happens if I start to struggle with moni?

How to build up your emergency savings to cover unexpected costs

Cryptocurrency

How to protect yourself from fraud and being scammed

About insurance

Insurance types

Insuring ourselves

Wills

Enduring powers of attorney

Family trusts

Insuring our homes

Losing a partner

Redundancy

Serious diagnosis

How to cope with the aftermath of fraud

Separation

About NZ Super – how much is it?

When you’re thinking of living in a retirement village

How to plan, save and invest for retirement

Manage your money in retirement

Find housing options in retirement

Four approaches to spending in retirement

Planning & budgeting

Saving & investing

How to build up your emergency savings to cover unexpected costs

How to save your money

How to start investing

Find a financial adviser to help you invest

Your investment profile

Compound interest

Net worth

Types of investments

Term deposits

Bonds

Investment funds

Shares

Property investment

View all

KiwiSaver

Tackling debt

How to use buy now pay later

What you really need to know before you use credit

How to get out of debt quickly

Credit reports

Know your rights

Pros and cons of debt consolidation

Credit cards

Car loans

Personal loans

Hire purchase

Student loans

Getting a fine

What happens if I start to struggle with moni?

View all

Protecting wealth

How to build up your emergency savings to cover unexpected costs

Cryptocurrency

How to protect yourself from fraud and being scammed

About insurance

Insurance types

Insuring ourselves

Wills

Enduring powers of attorney

Family trusts

Insuring our homes

Losing a partner

Redundancy

Serious diagnosis

How to cope with the aftermath of fraud

Separation

View all

Retirement

Home buying

3 November 2021

Reading time: 4 minutes

Posted by Sorted,

0 comments

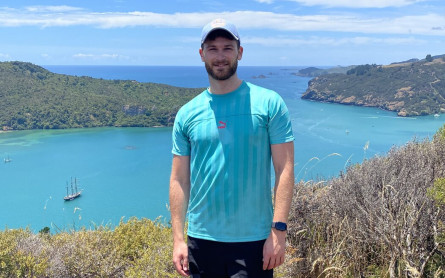

My Money Sorted is our series exploring people’s experiences with money and how they got Sorted. We spoke with Vaun, 27, originally from Hāwera, who now lives in Tāmaki Makaurau, working in IT. A proud member of the LGBTQI+ community, he’s an outgoing person who spends his spare time and money on sports, reading, cooking and being with friends and family.

Setting goals is key for me. If I don’t have anything to aim toward or achieve, it can be easy to spend more as I’m not motivated to save. Once I reach the goal, then I reassess what is next or if my motivations for saving have changed. Also, don’t compare yourself to others – everyone is on a different journey with money and no paths are the same.

I am a spender. I struggle to tell myself ‘no’ and find the differences between what I want versus what I need. I tend to go through peaks and valleys with saving. I can go a few months with consistent savings and then ‘boom’ – I’ll be in spending mode.

I save through automatic payments, and at the end of the pay cycle if I have any money left over I will transfer that into my savings. I also use this method of automatic payments for bills (rent, car payments) as this becomes somewhat untouchable when it comes to my spending account.

Up until recently I haven’t really had any motivation to save. I’ve always been the type to buy what I want and be quite short-sighted with my money, so I am thankful that I never got carried away and went beyond my means.

As I’m entering my late 20s, I’m starting to shift more focus onto other pathways to save rather than the one option.

I feel most Sorted when I’m able to cover unexpected costs that occur without using my credit card. Also, if my credit card is paid and I have a surplus in my accounts, that means I don’t need to rely on it for my weekly grocery shop or any other events for the week. Feeling sorted also means I don’t feel guilty when making a purchase – I know I have done the mahi and earned it.

A big ‘aha moment’ for me was when I finished university and sat down to access the timeline of paying back my student loan. This really gave me a perspective on a) how much the total value was versus my typical weekly and monthly income, and b) why it is important to research and evaluate options when it comes to larger financial decisions.

I was taught that money isn’t everything, but it does help. When I was growing up my parents were different in their approach to money. Mum was more frugal on the basics and the one who taught me to save up rather than take on debt. On the other hand, Dad worked hard and was a spender. I do wish there had been more in-depth courses or resources as a student to learn about money, savings and the opportunities to use money wisely.

To be honest, I have not thought about that a lot. At the moment, I’m grateful that I started KiwiSaver as soon as I was working at around 17. Ten years on, I can see it will definitely help me later in life. This is a head start for me buying my first home and for my retirement. I feel it is important to speak to others and have conversations about what they have for their retirement goals, and talk with those in retirement who can provide guidance and inform us of any mistakes they have made.

Use verification code from your authenticator app. How to use authenticator apps.

Code is invalid. Please try again

Don't have an account? Sign up

Or log in with our social media platforms

A free account gives you your very own space where you can save your tools and track your progress as you get ahead.

Or sign up using Google:

Comments (0)

Comments

No one has commented on this page yet.

RSS feed for comments on this page | RSS feed for all comments