28 March 2022

Reading time: 7 minutes

Posted by Tom Hartmann,

1 comment

We make heaps of sustainable choices as we buy everyday products these days, whether it be for fair-trade coffee and chocolate, local produce, or ethically made clothing.

But how about our investments on DIY platforms like Kernel, Stake, Sharesies or Hatch? As we’re picking funds or companies to invest in, we might be interested in investing sustainably, but it’s hard to know where to start sometimes. What does ‘sustainable’, ‘responsible’ or ‘ethical’ investing even mean?

“It’s about using your dollar to vote for the kind of future you’d like,” says Bella Conyngham, who works on partnerships at Toitū Tahua, the Centre for Sustainable Finance. “Money can be a powerful tool to help people and planet.”

“People of my generation are definitely choosing to invest with a bit of a conscience, with a bit of meaning behind it,” says Bella, 22. “For me, that means looking to invest in companies that care more about their stakeholders, the planet, their purpose, that longer-term vision for their company. What legacy will they leave, rather than just looking for returns?”

There’s been an explosion of this sort of investing across the board, increasing by 28% in 2020 to $142 billion, according to the Responsible Investment Association of Australasia (RIAA). Responsible investment assets are growing at twice the rate of overall professionally managed investments, but why are people so drawn to investing sustainably?

One reason, like Bella’s, is a values-based approach: do the right thing, create a better planet, and fund greener projects and sustainable products. We’re concerned about human rights, the environment, treatment of animals, weapons.

The second reason is that companies that are focused on sustainability should be better companies to invest in. Those that rate highly for their environmental, social and governance (ESG) standards should be good stewards of nature, have good relationships with their customers and communities, and have better leadership.

“People agree that high-ESG companies are high-quality companies,” explains John Berry, who heads New Zealand ethical fund manager Pathfinder.

“Every single fund in New Zealand is on a pathway toward integrating ESG, even the index funds,” says Barry Coates of Mindful Money, the ethical investing site that has seen its traffic quadruple over the past year.

“The whole market is shifting. Once upon a time, if you went to fund managers and asked if they practiced ESG integration, they would’ve looked at you funny. Now you would have 100%!”

Another shift that has been happening for ethical investors is from simply avoiding the bad stuff (eg, weapons, fossil fuels) to doing good stuff with money (eg, promoting renewable energy). Think of it as a spectrum:

Where do you sit on the spectrum? Reflecting on your approach can focus your decisions.

“How far do I want to take it? Do I just want to do no harm?” asks Bella. “Or do I want to be a guardian, a steward, and take it a step further? How can I be a steward of Papatuanuku, of Mother Nature, in a way that does not only not do harm, but has a positive externality?

“Having that reflection has been helpful.”

At this point we can declare a winner – that is, between two camps that once held opposing views of sustainable investing. One held that you could do good by investing, but that you couldn’t earn as much money. The other held that you could do good and do well at the same time, perhaps even better.

There’s plenty of evidence around showing you can have your cake and eat it – it is possible to invest sustainably and earn returns that are just as high. It can be done.

“You can get the performance, and you can sleep better at night,” John says. “You will get at least the market average – you’re not going to do worse, as long as you construct your portfolio properly. You can have both.” (Here’s more on how to do just that.)

And you shouldn’t pay extra for the privilege of investing sustainably, he says. “Your fees should be the same.”

“I have a strong set of boundaries for my investing,” says Bella, “so I don’t even consider anything unless it sits in that space of responsible investing. I’ve made a decision that that’s my line in the sand. I’m uniquely positioned to do that.”

But how do you do that? “You need to do your independent research,” advises John. “Research rather than make decisions based on emotion.”

There are a lot of tools out there to help. Here’s where to start when you’re looking into individual companies, managed funds, companies, or exchange-traded funds (ETFs).

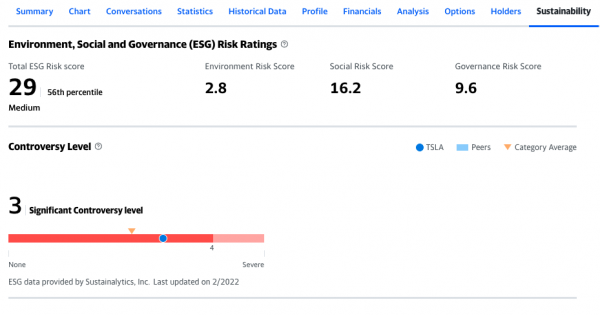

If you’re looking to invest directly in your favourite brand or company, start by Googling the company name and ‘ESG’, which will bring you to Yahoo! Finance – straight to their sustainability tab.

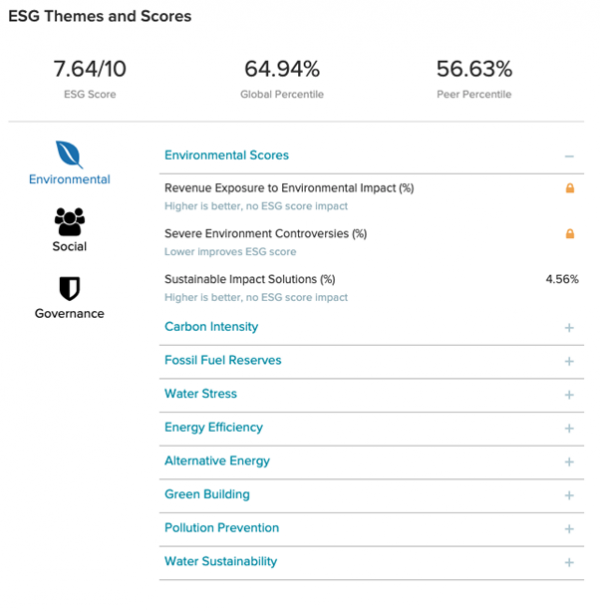

For exchange-traded funds, there’s ETFDB.com, where you can search up a given ETF and find a number of free ESG, sustainability and even carbon scores.

If you’re finding all this overly complex, it’s not complicated to start with your heart and find a company or fund that aims to make a difference.

“I’m still fairly early in my investing journey,” says Bella. “I chose funds rather than individual companies because of the diversity – it wasn’t relying on a single company’s performance.”

She is invested in a variety of funds, including one that invests in companies trying to solve the global water crisis.

“This is something I care about.”

Use verification code from your authenticator app. How to use authenticator apps.

Don't have an account? Sign up

Or log in with our social media platforms

A free account gives you your very own space where you can save your tools and track your progress as you get ahead.

Or sign up using Google:

Comments (1)

Comments

Grindl | 1 April 22

Unless we think about where our money is going and working on what, we will make the same mistakes some of us have done over the years, but then we didn't have much choice in terms of sustainable investments for the environment and society! Aotearoa could do much better in its housing building standards that support less fuel consumption to heat and run etc, just by better insulation and positioning of new buildings for installing solar and passive energy efficiency. Localised power stations so that you do not lose up to 15% of power travelling along pylons to another base. These are initiatives that can be implemented now, not sometime later! More community participation based projects with education and training. This is what pushes positive change and support forward.

No one has commented on this page yet.

RSS feed for comments on this page | RSS feed for all comments