Planning & budgeting

Saving & investing

KiwiSaver

Tackling debt

Protecting wealth

Retirement

Home buying

Life events

Setting goals

Money tracking

Plan your spending with a budget

Getting advice

Studying

Get better with money

What pūtea beliefs do you have?

How to build up your emergency savings to cover unexpected costs

How to save your money

How to start investing

Find a financial adviser to help you invest

Your investment profile

Compound interest

Net worth

Types of investments

Term deposits

Bonds

Investment funds

Shares

Property investment

How KiwiSaver works and why it's worth joining

How to pick the right KiwiSaver fund

Make the most of KiwiSaver and grow your balance

How KiwiSaver can help you get into your first home

Applying for a KiwiSaver hardship withdrawal

How to use buy now pay later

What you really need to know before you use credit

How to get out of debt quickly

Credit reports

Know your rights

Pros and cons of debt consolidation

Credit cards

Car loans

Personal loans

Hire purchase

Student loans

Getting a fine

What happens if I start to struggle with moni?

How to build up your emergency savings to cover unexpected costs

Cryptocurrency

How to protect yourself from fraud and being scammed

About insurance

Insurance types

Insuring ourselves

Wills

Enduring powers of attorney

Family trusts

Insuring our homes

Losing a partner

Redundancy

Serious diagnosis

How to cope with the aftermath of fraud

Separation

About NZ Super – how much is it?

When you’re thinking of living in a retirement village

How to plan, save and invest for retirement

Manage your money in retirement

Find housing options in retirement

Four approaches to spending in retirement

Planning & budgeting

Saving & investing

How to build up your emergency savings to cover unexpected costs

How to save your money

How to start investing

Find a financial adviser to help you invest

Your investment profile

Compound interest

Net worth

Types of investments

Term deposits

Bonds

Investment funds

Shares

Property investment

View all

KiwiSaver

Tackling debt

How to use buy now pay later

What you really need to know before you use credit

How to get out of debt quickly

Credit reports

Know your rights

Pros and cons of debt consolidation

Credit cards

Car loans

Personal loans

Hire purchase

Student loans

Getting a fine

What happens if I start to struggle with moni?

View all

Protecting wealth

How to build up your emergency savings to cover unexpected costs

Cryptocurrency

How to protect yourself from fraud and being scammed

About insurance

Insurance types

Insuring ourselves

Wills

Enduring powers of attorney

Family trusts

Insuring our homes

Losing a partner

Redundancy

Serious diagnosis

How to cope with the aftermath of fraud

Separation

View all

Retirement

Home buying

21 April 2021

Reading time: 5 minutes

Posted by Tom Hartmann,

5 comments

Do you get what you pay for? When you buy most things, you’re normally happy to pay a bit more – or maybe a whole lot more – to get superior stuff.

When we walk into a bottle shop, we expect the wine to be higher quality when it has a higher price tag. In fact, that tipple becomes a much better drop in our minds when we learn it costs more. It even tastes better!

In the world of finance – unlike your local bottle shop – paying more does not necessarily get you more. It’s not bottles of wine we’re buying, but financial products and services like loans or for a professional to manage our KiwiSaver money.

Money is expensive, and the more we pay, the worse of a deal it becomes for us. The financial product loses its lustre – as if the more we pay for a bottle, the worse it will taste.

Bizarre.

We don’t get a bill or invoice for the fees we pay in KiwiSaver – they’re deducted quietly behind the scenes, generally without us noticing. They’re typically shown in tiny percentage points, but they add up to tens of thousands of dollars over the years you’re in KiwiSaver. Have a look at our KiwiSaver fund finder to see for yourself.

It’s up to us to gauge if what we’re paying is worth it. The more we pay, the more it negatively affects our results. With the latest fees data now on Smart Investor, it’s easier than ever to get a transparent view of what’s happening with your fund.

What counts most with KiwiSaver are the returns, after fees and taxes have been taken out. On Smart Investor, the returns are all shown that way. This is about net results.

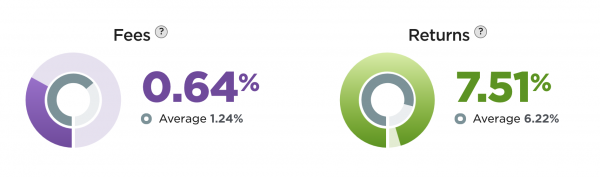

One of the lowest-fee balanced funds for which we have results for the past five years, for example, looks like this:

At left in purple, you can see that the fees for this fund are 0.64%, about half of the average for balanced funds (1.24%).

At right in green, you see an above-par 7.51% return over the past five years (the average was 6.22%). Those are the results after the 0.64% in annual fees (and taxes) were taken out.

So that would’ve been a good fund choice: low fees, high returns.

While we don’t want all our returns disappearing with fees, the lowest fees do not always guarantee the best results. We can’t just all race to the bottom and pick the cheapest option without looking at what we’re doing.

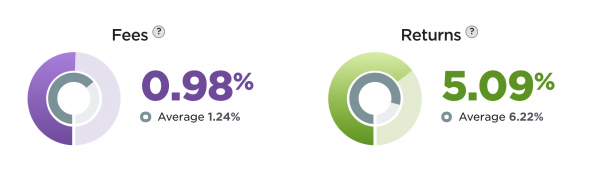

You might think this fund, for example, is still relatively cheap (0.98%) – quite a way below the average fee of 1.24% for balanced funds generally. But its results of 5.09% have been lacklustre, failing to keep pace with even the five-year average of 6.22%.

So that fund choice would’ve not been so good: lower fees, but also low returns.

The fund managers tell us: pay a bit more and we’ll get you better results. And they might.

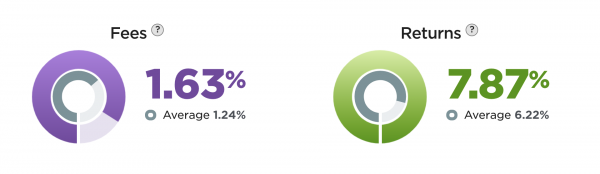

Here’s a good example: the top-performing balanced fund over the past five years, with high annual fees of 1.63% (way above that average of 1.24%).

That’s the category-best result of 7.87%, after taking out the fees and taxes. In this case, had we known what was to happen in these past five years, paying a bit more in fees would have been worth it – but only slightly.

So this fund would’ve been a good choice: high fees, but high returns too. However, there was always the risk that the returns wouldn’t have been as high, but the fees still would’ve been.

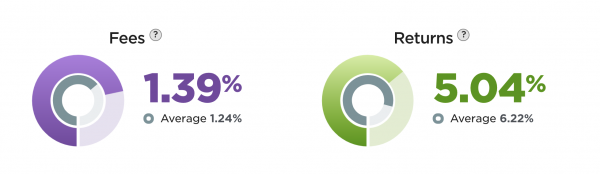

The thing is, paying more to get more doesn’t always work. Let’s say over the past five years you didn’t care about costs and decided on one with above-average fees. Spend a bit more, get a bit better result, right? Here’s what you might have chosen:

In this fund you would’ve been paying above-average fees (1.39%) for below-average performance (5.04%).

Had those fees been lower, the results would have been much improved. More of the value could have gone to you instead of to pay the fund manager.

That fund would not have been a good choice: high fees, low returns.

This is where finance defies the saying “You get what you pay for” – because you might not. More generally means less.

Paying more would be worth it if future returns were guaranteed – if the wine were already in the bottle.

Unfortunately it’s not. We can’t predict the future based on what’s happened thus far. Economies, markets, fund managers change.

Since there’s no crystal ball, most of us should just work on looking for the best deal and the lowest fees. Remember, fees are predictable – returns are not.

Thankfully we are more and more able these days to see the price tag – how much these funds cost. And in this bizarre world of finance, those fees are worth keeping an eye on.

Have a look for yourself and compare the fees you’re paying on Smart Investor.

Use verification code from your authenticator app. How to use authenticator apps.

Code is invalid. Please try again

Don't have an account? Sign up

Or log in with our social media platforms

A free account gives you your very own space where you can save your tools and track your progress as you get ahead.

Or sign up using Google:

Comments (5)

Comments

Tom from Sorted | 22 July 25

Thank you Ken – see our KiwiSaver fund finder for 5-year returns after fees and the sum of how much you could pay by age 65 in each fund.

Ken | 20 July 25

You've got the data; please create a graph of 5 yr returns vs fees.

Anonymous | 11 April 25

I like what I see

Alva | 26 May 24

Thank you for the easy to understand quick lesson

Peter Kimble | 24 February 19

Dear Sorted,

What a great guide re fees. Less fees over 20-30 years according to the late Jack Bogle (Vanguard) would usually be the best option.

No one has commented on this page yet.

RSS feed for comments on this page | RSS feed for all comments