Planning & budgeting

Saving & investing

KiwiSaver

Tackling debt

Protecting wealth

Retirement

Home buying

Life events

Setting goals

Money tracking

Plan your spending with a budget

Getting advice

Studying

Get better with money

What pūtea beliefs do you have?

How to build up your emergency savings to cover unexpected costs

How to save your money

How to start investing

Find a financial adviser to help you invest

Your investment profile

Compound interest

Net worth

Types of investments

Term deposits

Bonds

Investment funds

Shares

Property investment

How does KiwiSaver work? Here’s why it’s worth joining

How to pick the right KiwiSaver fund

Make the most of KiwiSaver and grow your balance

How KiwiSaver can help you get into your first home

Applying for a KiwiSaver hardship withdrawal

How to use buy now pay later

What you really need to know before you use credit

How to get out of debt quickly

Credit reports

Know your rights

Pros and cons of debt consolidation

Credit cards

Car loans

Personal loans

Hire purchase

Student loans

Getting a fine

What happens if I start to struggle with moni?

How to build up your emergency savings to cover unexpected costs

Cryptocurrency

How to protect yourself from fraud and being scammed

About insurance

Insurance types

Insuring ourselves

Wills

Enduring powers of attorney

Family trusts

Insuring our homes

Losing a partner

Redundancy

Serious diagnosis

How to cope with the aftermath of fraud

Separation

About NZ Super – how much is it?

When you’re thinking of living in a retirement village

How to plan, save and invest for retirement

Manage your money in retirement

Find housing options in retirement

Four approaches to spending in retirement

Planning & budgeting

Saving & investing

How to build up your emergency savings to cover unexpected costs

How to save your money

How to start investing

Find a financial adviser to help you invest

Your investment profile

Compound interest

Net worth

Types of investments

Term deposits

Bonds

Investment funds

Shares

Property investment

View all

KiwiSaver

Tackling debt

How to use buy now pay later

What you really need to know before you use credit

How to get out of debt quickly

Credit reports

Know your rights

Pros and cons of debt consolidation

Credit cards

Car loans

Personal loans

Hire purchase

Student loans

Getting a fine

What happens if I start to struggle with moni?

View all

Protecting wealth

How to build up your emergency savings to cover unexpected costs

Cryptocurrency

How to protect yourself from fraud and being scammed

About insurance

Insurance types

Insuring ourselves

Wills

Enduring powers of attorney

Family trusts

Insuring our homes

Losing a partner

Redundancy

Serious diagnosis

How to cope with the aftermath of fraud

Separation

View all

Retirement

Home buying

23 September 2019

Reading time: 4 minutes

Posted by Tom Hartmann,

0 comments

Living “sorted” is not just good for your bank balance; it’s good for your mental health, too. The line connecting financial wellbeing with general wellbeing is easy to draw.

To support Mental Health Awareness Week, we surveyed more than 2,600 people. Far too many of us are worried about our finances. It turns out 69% of us are concerned about money, and that affects us in all sorts of ways.

Some of us are feeling the pinch more than others: 74% of women and 82% of those aged 18–34. Māori and Pasifika were also particularly affected – 83% of Māori and 82% of Pasifika were concerned about money, compared to 67% of NZ Europeans. That is so high!

All of this, of course, affects our mindsets and mental wellbeing. And it makes us think and act in a variety of ways. Those surveyed reported that their money concerns made them:

Only 8% sought help to deal with money-related stress. Which is a shame, because there is help available.

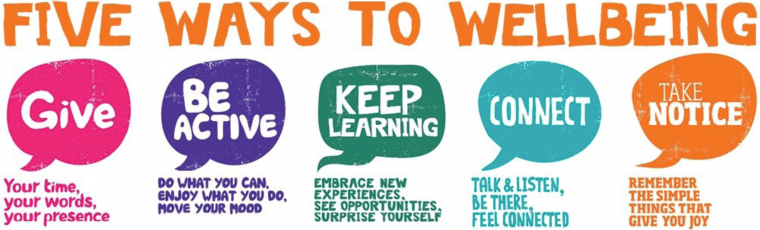

Mental health experts have found five ways to help boost wellbeing. Each of these everyday activities can be done with your money as well.

Talking about money is admittedly challenging, and debt especially brings silence. Yet sharing a problem can be the best way to begin to tackle it. If you’re getting ready to open your own money chat with someone close to you, you’ll find ideas and support here.

It’s easy to get in a funk about your money situation sometimes. But there are active steps you can take to make things better. If you’re looking to sort your finances (and improve your mental wellbeing in the process), here are our six steps to start. Just setting up a safety net will see your anxiety levels come down. Here’s to that!

How much value do we get for our money? Paying more does not necessarily mean we get something of better quality. Can we buy more Christmas by spending more on gifts? Questions like these help us focus on spending money only on things that will improve our wellbeing.

And your money. This is the obvious one – being generous. But we can also “give” our needs when we have them. Putting them on the table means that we open up to connecting with others. Feeling gratitude has been shown to help us make better money choices as well.

For most of us in KiwiSaver, investing our savings is brand new territory to be explored. Where is our money flowing? What investments are we buying? Are they ethical? There is a world of opportunities to look into and make choices about. The more we learn, the more we can get our money working for us, instead of us working for it. And through our decisions, we can better the world in the process. Surprise yourself!

Mental Health Awareness Week is 23–29 September. If you feel you or someone else is at risk or harm right now, phone 111 or see these other options. For free, confidential help with your finances, reach out to the team at MoneyTalks.

Use verification code from your authenticator app. How to use authenticator apps.

Code is invalid. Please try again

Don't have an account? Sign up

Or log in with our social media platforms

A free account gives you your very own space where you can save your tools and track your progress as you get ahead.

Or sign up using Google:

Comments (0)

Comments

No one has commented on this page yet.

RSS feed for comments on this page | RSS feed for all comments