Planning & budgeting

Saving & investing

KiwiSaver

Tackling debt

Protecting wealth

Retirement

Home buying

Life events

Setting goals

Money tracking

Plan your spending with a budget

Getting advice

Studying

Get better with money

What pūtea beliefs do you have?

How to build up your emergency savings to cover unexpected costs

How to save your money

How to start investing

Find a financial adviser to help you invest

Your investment profile

Compound interest

Net worth

Types of investments

Term deposits

Bonds

Investment funds

Shares

Property investment

How does KiwiSaver work? Here’s why it’s worth joining

How to pick the right KiwiSaver fund

Make the most of KiwiSaver and grow your balance

How KiwiSaver can help you get into your first home

Applying for a KiwiSaver hardship withdrawal

How to use buy now pay later

What you really need to know before you use credit

How to get out of debt quickly

Credit reports

Know your rights

Pros and cons of debt consolidation

Credit cards

Car loans

Personal loans

Hire purchase

Student loans

Getting a fine

What happens if I start to struggle with moni?

How to build up your emergency savings to cover unexpected costs

Cryptocurrency

How to protect yourself from fraud and being scammed

About insurance

Insurance types

Insuring ourselves

Wills

Enduring powers of attorney

Family trusts

Insuring our homes

Losing a partner

Redundancy

Serious diagnosis

How to cope with the aftermath of fraud

Separation

About NZ Super – how much is it?

When you’re thinking of living in a retirement village

How to plan, save and invest for retirement

Manage your money in retirement

Find housing options in retirement

Four approaches to spending in retirement

Planning & budgeting

Saving & investing

How to build up your emergency savings to cover unexpected costs

How to save your money

How to start investing

Find a financial adviser to help you invest

Your investment profile

Compound interest

Net worth

Types of investments

Term deposits

Bonds

Investment funds

Shares

Property investment

View all

KiwiSaver

Tackling debt

How to use buy now pay later

What you really need to know before you use credit

How to get out of debt quickly

Credit reports

Know your rights

Pros and cons of debt consolidation

Credit cards

Car loans

Personal loans

Hire purchase

Student loans

Getting a fine

What happens if I start to struggle with moni?

View all

Protecting wealth

How to build up your emergency savings to cover unexpected costs

Cryptocurrency

How to protect yourself from fraud and being scammed

About insurance

Insurance types

Insuring ourselves

Wills

Enduring powers of attorney

Family trusts

Insuring our homes

Losing a partner

Redundancy

Serious diagnosis

How to cope with the aftermath of fraud

Separation

View all

Retirement

Home buying

9 May 2016

Reading time: 3 minutes

Posted by Tom Hartmann,

2 comments

What goes up, must pay out. Just last week a friend was impressed how, after hopping onto the KiwiSaver bandwagon back when it started in 2007, he is now seeing his balance edge past $70,000. With many more years of contributing ahead, he and his family are on track to accumulate more than a modest bit of dosh for their future.

But what happens when they become eligible to withdraw it all? How will they manage hundreds of thousands of dollars in a way that will provide them with regular payments without running out of money? What happens if they want to spend on some big things like a car or trip overseas – does that mean they won’t eat as well in their 80s? It’s complicated.

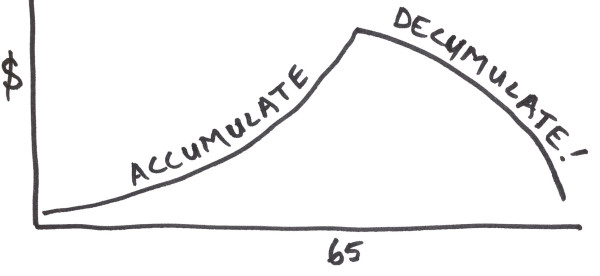

Converting retirement savings to income is being called “decumulation”, but the word hasn’t quite arrived yet; there are no matches on Oxford online, for instance. When it comes to spending the retirement fund, perhaps it could have been “draw-down” or “decrease” – but hopefully not “dispose” or “destroy”!

“Decumulate” really only makes sense if you couple it with its partner, “accumulate” – heaping up funds by investing in schemes like KiwiSaver and then managing those funds in a way to get a steady income in retirement. So not the prettiest of terms, “decumulation”, but fundamentally important to understand when you’re forward thinking.

The stakes are high. When I think about the newly retired, what comes to mind are high-earning sports figures or lottery winners, and many of us will have heard their hard-luck stories of money lost. Just like them, retirees have incredibly important choices to make for their money saved, with slim chance of becoming rich all over again if they make a poor one. There’s no real practice for this, so planning, studying options and getting quality advice become all the more essential.

Sorted’s retirement planner estimates how much of a regular income we can expect when we build up a certain amount. It’s not the nest egg that matters, but what the chicks look like, after all. But the tool does not show anyone how to actually generate income from a lump sum. It takes some savvy investing to do this and not run out of money.

An online poll on these issues is part of this year’s review of retirement income policies. At the time of writing it shows:

Happily, there are some solutions for spinning off a regular income in retirement. For instance, you could arrange with your KiwiSaver provider to draw down your funds gradually, leaving the rest still invested until you need it. For some, releasing the equity of their home through a reverse mortgage may be useful. Also, financial planners can design investment strategies for your nest egg that keep those “chicks” coming regularly.

So these are some ways to tackle the D-word: “decumulation” – which is worth thinking about as we’re “accumulating” savings for retirement. What will be your solution?

Use verification code from your authenticator app. How to use authenticator apps.

Code is invalid. Please try again

Don't have an account? Sign up

Or log in with our social media platforms

A free account gives you your very own space where you can save your tools and track your progress as you get ahead.

Or sign up using Google:

Comments (2)

Comments

Tom from Sorted | 8 January 26

Thanks for commenting Caryl, and for bringing up those rules of thumb. Since this blog was written we came out with a guide that covers those approaches and more, which you'll find here: https://sorted.org.nz/guides/retirement/four-approaches-to-spending-in-retirement/. Don't miss our new retirement navigator tool above too, which runs scenarios for your spending after you step back from paid work someday...

Caryl | 2 January 26

Good general information but no detailed explanation for the 4% and 6% drawdown rules.

No one has commented on this page yet.

RSS feed for comments on this page | RSS feed for all comments