When a celebrity’s spending gets out of hand, sometimes their accountants will cut up their credit cards and simply make them carry a cash-stuffed envelope instead. That helps to get things back in control.

There’s a lot been said about managing credit cards. You know: avoid the fees, get the rewards, pay it off in full each month. And slightly more of us (51%) do just that, pay them off every month.

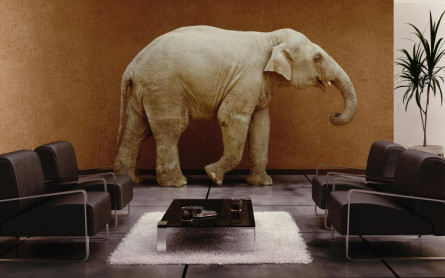

But there’s a credit elephant in the room that we conveniently ignore: it’s that we spend a lot more when it’s on plastic.

How much more? A number of studies show how and why people spend more on credit than with cash, but there’s no consensus as to how much. Some put the figure as high as 30% more, or even higher!

Now this is not really a frugality blog, about cutting spending at all costs. It’s aboutsticking to a plan and staying on track. You need to be in control.

Is this what we want to be doing with our money? Try tracking your credit card purchases for 14 days and see where your money’s flowing, just to make sure.

There’s been ground-breaking work in the field of neuroeconomics – for example, how our brains work differently when we’re using credit than if we were paying with cash.

When we pay with cash, our brains make the trade-off between the pain of parting with our dollars and the pleasure of getting whatever we’re buying. On credit, that pain gets removed from the picture entirely, and it’s all pleasure for the moment.

Our brains are also not very good at keeping tabs on all the individual things we spend on, so when that monthly bill comes around, it’s typically more than we thought it would be.

So if you or someone you’re close to is living on a credit card, you may want to try moving to cash, or using real money with a debit card.

That way you stick to your plan – not someone else’s.

Comments (0)

Comments

No one has commented on this page yet.

RSS feed for comments on this page | RSS feed for all comments