Planning & budgeting

Saving & investing

KiwiSaver

Tackling debt

Protecting wealth

Retirement

Home buying

Life events

Setting goals

Money tracking

Plan your spending with a budget

Getting advice

Studying

Get better with money

What pūtea beliefs do you have?

How to build up your emergency savings to cover unexpected costs

How to save your money

How to start investing

Find a financial adviser to help you invest

Your investment profile

Compound interest

Net worth

Types of investments

Term deposits

Bonds

Investment funds

Shares

Property investment

How KiwiSaver works and why it's worth joining

How to pick the right KiwiSaver fund

Make the most of KiwiSaver and grow your balance

How KiwiSaver can help you get into your first home

Applying for a KiwiSaver hardship withdrawal

How to use buy now pay later

What you really need to know before you use credit

How to get out of debt quickly

Credit reports

Know your rights

Pros and cons of debt consolidation

Credit cards

Car loans

Personal loans

Hire purchase

Student loans

Getting a fine

What happens if I start to struggle with moni?

How to build up your emergency savings to cover unexpected costs

Cryptocurrency

How to protect yourself from fraud and being scammed

About insurance

Insurance types

Insuring ourselves

Wills

Enduring powers of attorney

Family trusts

Insuring our homes

Losing a partner

Redundancy

Serious diagnosis

How to cope with the aftermath of fraud

Separation

About NZ Super – how much is it?

When you’re thinking of living in a retirement village

How to plan, save and invest for retirement

Manage your money in retirement

Find housing options in retirement

Four approaches to spending in retirement

Planning & budgeting

Saving & investing

How to build up your emergency savings to cover unexpected costs

How to save your money

How to start investing

Find a financial adviser to help you invest

Your investment profile

Compound interest

Net worth

Types of investments

Term deposits

Bonds

Investment funds

Shares

Property investment

View all

KiwiSaver

Tackling debt

How to use buy now pay later

What you really need to know before you use credit

How to get out of debt quickly

Credit reports

Know your rights

Pros and cons of debt consolidation

Credit cards

Car loans

Personal loans

Hire purchase

Student loans

Getting a fine

What happens if I start to struggle with moni?

View all

Protecting wealth

How to build up your emergency savings to cover unexpected costs

Cryptocurrency

How to protect yourself from fraud and being scammed

About insurance

Insurance types

Insuring ourselves

Wills

Enduring powers of attorney

Family trusts

Insuring our homes

Losing a partner

Redundancy

Serious diagnosis

How to cope with the aftermath of fraud

Separation

View all

Retirement

Home buying

14 March 2018

Reading time: 3 minutes

Posted by Tom Hartmann,

0 comments

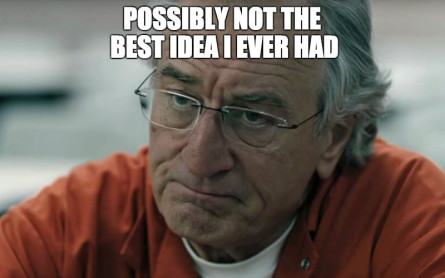

There’s a key moment in Robert De Niro’s new portrayal of Ponzi schemer Bernie Madoff, in The Wizard of Lies. Pronounced “made off”, he infamously “made off” with billions in an estimated $64.8 billion scheme that collapsed in 2008, the largest fraud on record.

It’s a scene where an investor’s simple act of asking challenging questions keeps $400 million safe.

The film features dizzying amounts of money, and De Niro’s character has just persuaded a single investor to put in $400 million. To do that, the Ponzi operator plays “hard to get”, making his scheme seem like an exclusive club where you pay to play. The investor falls for the ruse and shakes on the deal.

But the money never turns up. “What happened to that guy?” De Niro later asks his partner in crime (played sleazily by Hank Azaria). The promised $400 million is money he desperately needs, as many other of his investors happen to be running for the door and pulling their money out.

Since a Ponzi scheme relies on new money coming in to pay existing investors (instead of real investment returns), the house of cards will collapse if it doesn’t.

“That guy, he asked too many questions,” complains Azaria’s character. Questions like where the money was invested, where the money was held, what kind of investments were being made. The preliminary questions anyone should ask as they start their “due diligence”, whether they’re investing $400 million or just $400.

And just like that, Madoff has to give up on that investor ever putting money in. It doesn’t take many probing questions from an investor before he and his underlings must move on and look for some other target.

Now I wish I could say that Ponzi schemes are an “only in America” phenomenon like the Madoff case. Although the numbers are far more modest, scarily similar things have happened here in New Zealand.

The country’s biggest Ponzi scheme operator has been David Ross, who defrauded close to 700 investors. An estimated $115.5 million was lost. Shane Scott deceived investors with a $5.4 million scheme. Paul Hibbs’ Ponzi was $17.5 million.

The toll on individual investors and their lifestyles can be shattering, especially retirees with little opportunity to recover. One couple, for example, may have tragically lost as much as $650,000 when they invested at the suggestion of an “ultra-diligent friend” – who also purportedly lost everything.

I also wish I could say that avoiding the fraudsters’ nets will always be so simple – that asking just a few questions will keep our money safe. It often takes fraud investigators years to unravel where the money has wound up.

But asking challenging questions is a good place to start to protect ourselves. There’s simply no point building up a lifetime of savings only to lose it when you need it most: the years after you ease up from paid work.

Use verification code from your authenticator app. How to use authenticator apps.

Code is invalid. Please try again

Don't have an account? Sign up

Or log in with our social media platforms

A free account gives you your very own space where you can save your tools and track your progress as you get ahead.

Or sign up using Google:

Comments (0)

Comments

No one has commented on this page yet.

RSS feed for comments on this page | RSS feed for all comments