2 December 2021

Reading time: 4 minutes

Posted by Tom Hartmann,

0 comments

So they’ve arrived – those balanced KiwiSaver default funds that were announced back in May. Many of us will get a lot out of these new funds. We’ll pay less, see better service and get better returns in a fund that is ethically invested.

Those in the old default funds – who didn’t make a choice for themselves – are being moved to a new one. Their new default fund will be either with the same provider (if reappointed), or with an entirely new company.

As the new funds roll out, this is a great opportunity for everyone to check in and choose your fund – that way you can make extra sure it works best for you. And if you find yourself in a default fund, you may decide to stay – but at least it’s your choice.

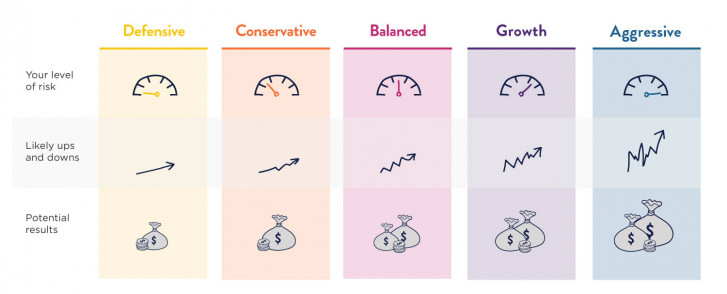

One of the big changes to these default funds – which thousands of new KiwiSaver members will join automatically each month (unless they choose another) – is that they are ‘balanced’ instead of ‘conservative’. This means they hold more of the riskier investments like shares and commercial property.

Over the long run, members should get better results from the new settings and grow their money more with a balanced fund than they would in a conservative one. Sounds good, right? If you're shopping around for a balanced fund, these new default funds are an option.

But many of us who have more than ten years to go before we’ll be using our KiwiSaver money will want to take advantage of the potential returns from a growth or even aggressive fund.

You can see how much difference this could make for you with our KiwiSaver calculator.

The six newly appointed default providers – BNZ, Booster, Kiwi Wealth, Simplicity, Superlife (from NZX’s Smartshares) and Westpac – have created entirely new funds that:

Here are the newly created default funds and links to all the information about them available so far:

So there are two entirely new providers who now offer default funds: Simplicity and Superlife, and theirs are the cheapest. (At the time of writing, information about Booster and Westpac was not available.)

The average fee for KiwiSaver balanced funds sits at 1.27% (it’s easy to see on Smart Investor how high these can get), but the fees for the new default funds will be heaps lower:

|

KiwiSaver provider |

Single fee percentage |

|

BNZ |

0.35% |

|

Booster |

0.35% |

|

Kiwi Wealth |

0.37% |

|

Simplicity |

0.31% |

|

Smartshares |

0.20% |

|

Westpac |

0.40% |

To give an idea, by investing in a default fund, we estimate a member earning $50,000 per year would pay $2,400 less in fees over their entire KiwiSaver experience (ages 18–65) than they would in an average balanced fund.

No default provider will charge a fixed annual or monthly fee for these funds, either. That’s a good thing, since these fixed fees tend to affect members with low balances more, while percentage-based fees affect those with higher balances. Fees are some of the surprising KiwiSaver figures worth keeping an eye on.

But how do you know if a balanced fund is right for you? What type would suit you best?

Glad you asked – our guide on how to pick your KiwiSaver fund should help. Instead of just looking at a fund or two that your provider offers, ideally you should be selecting from all the funds of your type available out there.

Although the KiwiSaver system has default settings to get people started, it’s good to make your own choices to make sure you get the most out of it.

Remember how you got started in KiwiSaver? For many of you, the system did it all at first: you were enrolled automatically, started contributing the minimum 3%, and the government chose a KiwiSaver provider and fund for you.

It’s one of the brilliant things about KiwiSaver – you start saving and investing straight away. To make this happen, the government appoints default providers. The default settings have to be spot on for everyone who rolls into KiwiSaver automatically.

Every seven years, the government reviews the settings for default funds ahead of appointing a new set of default providers through a competitive tender process. In doing so, they are able to tweak the settings to slash fees and boost results for KiwiSaver investors.

If you were in a default fund with one of the four providers that have been reappointed – BNZ, Booster, Kiwi Wealth or Westpac – you are simply being switched to their new default fund.

If you were in a default fund with another provider that wasn’t reappointed – AMP, ANZ, ASB, Fisher Funds or Mercer, and you didn’t choose to stay there – you are automatically being switched to one of the funds in the list above.

Those in default funds are automatically being transferred to one of the newly created default fund after 1 December – if they didn’t choose another fund first. If that's you, expect to hear directly from your new provider.

If you know you’re in KiwiSaver, but are not sure which company you’re with, you can log in to myIR to find out.

You can check in with your current KiwiSaver provider to find out where your money is flowing.

These changes won’t affect you directly. But if a balanced KiwiSaver fund is right for you, you could consider switching to one of the new default funds, since they are a low-cost, ethical option.

The companies that were not reappointed – AMP, ANZ, ASB, Fisher Funds and Mercer – are still KiwiSaver providers, licensed and monitored by the Financial Markets Authority.

The difference is that those providers will no longer be automatically allocated KiwiSaver members by the government.

But if you choose to stay with them, you will still get all the benefits of KiwiSaver.

Use verification code from your authenticator app. How to use authenticator apps.

Don't have an account? Sign up

Or log in with our social media platforms

A free account gives you your very own space where you can save your tools and track your progress as you get ahead.

Or sign up using Google:

Comments (0)

Comments

No one has commented on this page yet.

RSS feed for comments on this page | RSS feed for all comments