Planning & budgeting

Saving & investing

KiwiSaver

Tackling debt

Protecting wealth

Retirement

Home buying

Life events

Setting goals

Money tracking

Plan your spending with a budget

Getting advice

Studying

Get better with money

What pūtea beliefs do you have?

How to build up your emergency savings to cover unexpected costs

How to save your money

How to start investing

Find a financial adviser to help you invest

Your investment profile

Compound interest

Net worth

Types of investments

Term deposits

Bonds

Investment funds

Shares

Property investment

How KiwiSaver works and why it's worth joining

How to pick the right KiwiSaver fund

Make the most of KiwiSaver and grow your balance

How KiwiSaver can help you get into your first home

Applying for a KiwiSaver hardship withdrawal

How to use buy now pay later

What you really need to know before you use credit

How to get out of debt quickly

Credit reports

Know your rights

Pros and cons of debt consolidation

Credit cards

Car loans

Personal loans

Hire purchase

Student loans

Getting a fine

What happens if I start to struggle with moni?

How to protect yourself from fraud and being scammed

About insurance

Insurance types

Insuring ourselves

Wills

Enduring powers of attorney

Family trusts

Insuring our homes

Losing a partner

Redundancy

Serious diagnosis

How to cope with the aftermath of fraud

Separation

About NZ Super

This year's NZ Super rates

When you’re thinking of living in a retirement village

How to plan, save and invest for retirement

Manage your money in retirement

Find housing options in retirement

Four approaches to spending in retirement

Planning & budgeting

Saving & investing

How to build up your emergency savings to cover unexpected costs

How to save your money

How to start investing

Find a financial adviser to help you invest

Your investment profile

Compound interest

Net worth

Types of investments

Term deposits

Bonds

Investment funds

Shares

Property investment

View all

KiwiSaver

Tackling debt

How to use buy now pay later

What you really need to know before you use credit

How to get out of debt quickly

Credit reports

Know your rights

Pros and cons of debt consolidation

Credit cards

Car loans

Personal loans

Hire purchase

Student loans

Getting a fine

What happens if I start to struggle with moni?

View all

Protecting wealth

Retirement

Home buying

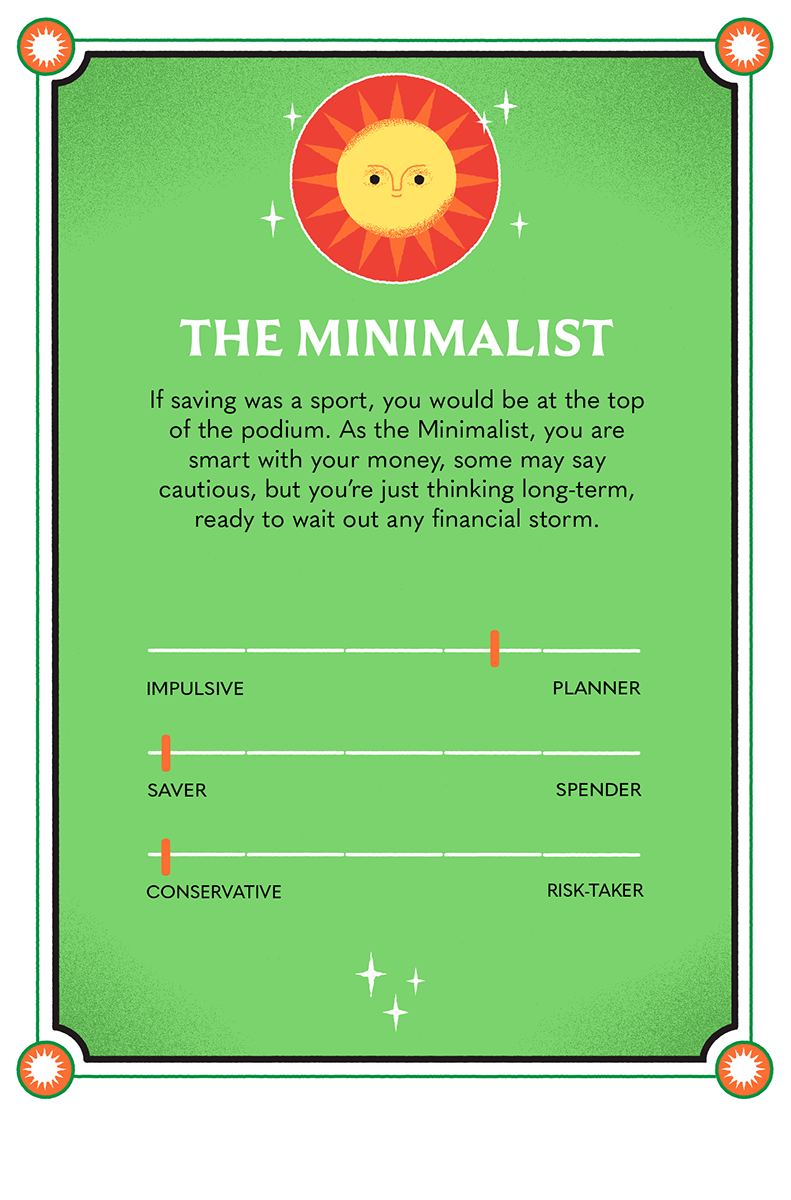

Smart with your money (some might say cautious), you’re just thinking long-term, ready to wait out any financial storm.

If saving was a sport, you'd be at the top of the podium. You're smart with your money (some might say cautious), but you’re just thinking long-term, ready to wait out any financial storm.

You like to be the one making decisions about your finances. Keeping your cash close to your chest.

Knowledge is power, and you’ve learned you can never be too safe with your money.

A savant in saving, you’re good with your money and you know it.

You’re on the sure path to saving as the Minimalist. You’re confident in managing your money and have a keen eye on monitoring your incomings and outgoings. By not being overly impulsive you save yourself from unnecessary spending, suggesting simple tastes and a good head on your shoulders for thinking money decisions through. Saving is your superpower but since you’re constantly focused on building your bank account, you are highly averse to taking any risks for fear that you may lose out. Some passive strategies and more diversified investments may be just what you need to make your money work a little harder.

Build your resilience with a starter emergency fund, or a more robust safety net that will get you through it all.

Putting your money to work – not just you working for it – can be a big part of your future.

Risking money is not pleasant, but not growing your money enough in the long term won’t be that comfortable either.

Tool

Find an investing strategy that suits you best. As you put your money to work, how much risk is right for you? It depends on your personality, situation and the timeframe you’re investing for. Build your investor profile here.

Tool

Whether you are looking for a new fund or just want to see how your current one compares, this tool rates them all and lets you see how much you could pay in fees over your entire KiwiSaver experience.

Guide

Investing is all about buying things that put money back into our pockets. Sound intimidating? It’s really not. Those of us who have a bank term deposit or are in KiwiSaver – we’re already investors!

Guide

Investing is the best way to grow wealth and get our money working for us – but how? There are many kinds of investments out there, each with its own level of risk and return.

Blog

An inflation explainer as prices rise and your buying power falls

Blog

As you make your money choices, focus on what gives you the most emotional payoff.

Use verification code from your authenticator app. How to use authenticator apps.

Code is invalid. Please try again

Don't have an account? Sign up

Or log in with our social media platforms

A free account gives you your very own space where you can save your tools and track your progress as you get ahead.

Or sign up using Google: