Putting your money into a fund – so it’s pooled with other people’s money and invested for you – is an easy way to get started with investing. You may have heard of managed funds, exchange-traded funds (ETFs) and index funds, but what are they?

Funds make investing simple, because you don’t need to research individual companies. Your money is spread across a range of investments, which makes it easier to not have all your eggs in one basket (diversification). If you’re in KiwiSaver, you’re already investing in this way.

Funds can have a huge range of strategies or approaches, so you’ll likely find one that suits you and the goals you have for your investing.

When you invest in KiwiSaver, you’re putting your savings into one or more managed funds. The scheme is designed to help you achieve two goals: a first home and retirement.

Managed funds and ETFs are a portfolio of assets (kinds of investments) that are chosen by a fund manager. This makes it a good way to get started, as they research and select the investments for you. These funds are typically diversified from your very first dollar, which makes it much easier to spread your risk compared to picking individual shares.

Some funds (managed funds or ETFs) are set up to automatically follow a benchmark index like the S&P/NZ 50 or the S&P 500. These are called ‘index’ funds. The fund manager typically sets up the fund to follow the index by buying and holding company shares to match the index, but then is more ‘hands off’.

From the investors’ perspective, managed funds and ETFs are pretty much the same, as they are pools of investments held on investors’ behalf. The value of a managed fund is typically calculated only at the end of the day. ETFs are a bit different in that the units of the fund, which is what an investor owns, are listed on an exchange. (See below for more on units.) They can be bought and sold throughout a trading day, so their value is determined by what investors are willing to pay for them at a particular time of day.

When you put money into a fund, you’re buying units. Units are a way of keeping track of what we own in that fund. These units are linked to the assets our fund has invested in, such as shares, commercial property or bonds.

Think of the fund and its underlying investments like a big fat orange – and our units as a segment of that. When the orange rises or falls in value, so does the value of our segment.

Unlike a savings account, where we’re setting money aside, in funds we are buying things that have value. That orange can be priced higher on the market at some times, lower at others.

When we look at a savings account balance, we rightly think about how much we have. Not so with our fund balance. When we look at that, what we’re really seeing is how much our fund’s investments and our corresponding units are worth – what their value is right now.

Instead of asking ourselves how much we have in a fund, we should be asking, “How much is my fund worth at the moment?” Might be higher, might be lower. Investment returns can be positive or negative.

The value of your units will often rise over time, giving you a return and growing your money (a capital gain). But there is always the risk that their value can drop below what you paid for them. The investments in the fund become worth more or less as markets go up and down, which means our balance will follow suit.

Especially over the long-term, fund values are generally expected to grow. So the idea is to stay in for the long term and ride out any ups and downs. When markets are down, it can feel like you’re losing money, but it’s only on paper. The loss only becomes real if you panic and suddenly withdraw your money.

How much risk you take on when you invest in a fund depends on what the fund holds. For example, if it holds more shares or commercial property, it will see more ups and downs, but have a greater chance of growth over the long term. If it holds mostly bonds or other less risky investments, it will be more ‘steady’, but could see lower returns.

So ultimately, more risk means more potential returns. Think of those returns as you being paid for taking on that risk.

The most important thing is that it is fundamentally easier to spread your risk (diversification) in a fund because your eggs are not all in one basket and your money is distributed among a wide range of assets.

Below are some of the risks to be aware of when you are investing in funds. This is not to put you off, but rather to help you take into account the level of risk you are choosing when you aim for the rewards!

If your fund invests heavily in a specific market, like the USA, there is a chance that if that market has a downturn your fund will follow suit.

When your fund invests in shares or bonds from a given company, there is the chance that they will fall in value if the company’s financial situation or credit rating takes a hit.

If a fund holds investments overseas, changes in exchange rates can cause the value of the fund to fall.

For bonds, which are a form of debt, there is the chance that the organisation will not repay either the interest or the amount borrowed – or both.

Changes in interest rates can drive the value of a fund and the investments it holds up or down. This particularly affects funds that hold bonds and cash.

For funds that mimic the investments of a specific index, there is a chance that the fund manager is not able to exactly follow changes to the index. This can result in the fund having a lower return than the index itself.

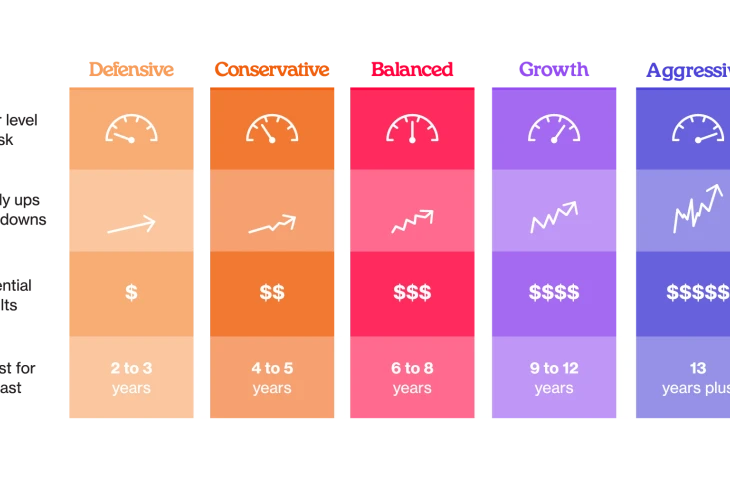

Depending on how long you are investing for and your attitude towards risk, one type (defensive, conservative, balanced, growth or aggressive) will probably work best for you. These categories are based on the proportion of riskier investments (shares, commercial property) each fund holds.

When you’re choosing which fund is right for you, you’ll find that some funds are active and some are passive (because they track an index), and many are a mix of both.

Active funds have managers who aim to get the best results by choosing investments that they think will beat the market and trading them. This generally makes them more expensive, to pay for the manager’s time in researching and trading costs. But if the manager is successful the higher returns could be worth these fees.

Passive funds simply invest to match a market index, and in turn its performance, without the fund managers specifically choosing individual investments and trading often. So passively managed funds are also known as index funds. For example, a fund might hold the same investments as an index of shares. This generally makes them cheaper, and you’ll find passively managed funds among the lowest-cost funds.

If you’re browsing through funds on Smart Investor, you’ll be able to sort and compare them based on the fees charged. Also, the returns shown are all after fees have been taken out. This is particularly important, since even though fees are shown in tiny percentage amounts, they can add up to tens of thousands of dollars, especially over long periods.

In the world of investing, paying more does not necessarily get you more. Cheapest is not always best, but higher fees paid to your fund manager will cut into your pot of returns. And while we can’t predict what future returns will be like, we can see what the costs will be. If you’re curious, see our KiwiSaver fund finder, which forecasts fees over time and will give you an idea of how they can add up.

If it’s important to you for your money to be invested according to ethical or sustainability values, check the investments the fund holds to make sure they’re a good fit.

Funds must provide a Statement of Investment Policy and Objectives (SIPO) that explains what the fund is trying to achieve and the rules about what the fund can and cannot invest in.

They often also have a responsible investment policy that will show how they manage environmental, social or governance risks, and whether they exclude certain investments to do so.

You can contact your KiwiSaver or fund provider to find out more.

If you are aiming to invest your money ethically, or to contribute to sustainable goals and companies, Mindful Money helps you understand what investments managed funds hold and whether they align with your values.

Understand what types of investments suit your goals, timeline and attitude to risk with our tool. See what types of results you can expect, find out your mix and simulate your investment results.

Yes – mutual funds are just the North American name for the same type of investment fund – pools of investor money directed by a fund manager. In New Zealand, it is common for funds to be referred to as unit trusts, too.

Both managed funds and ETFs are pools of money invested in assets by a professional fund manager. The chief difference between ETFs and managed funds is that units of the ETF are listed on an exchange, meaning the value of ETFs can change throughout the day like shares. Managed funds are typically valued once a day.

If you are investing in an ETF directly, you would typically have to use a third-party broker or investing platform to buy units in the fund, which means you will pay brokerage or transaction fees on each investment. Managed funds are not listed on an exchange and can be bought directly from the fund manager or via a third party, often without any transaction fees.

What makes an ETF – or any managed fund – an index fund is that the fund manager’s style is passive and tracks an index. The fund mimics the holdings of a specific index, like the S&P 500. As the index changes, the fund tracks it and changes its investments accordingly.

Some ETFs are index funds. Here’s an example from Smartshares. It’s an ETF that tracks the Vanguard Total World Stock index.

Not all ETFs track an index, though. They can be actively managed, and investors will need to check to determine the investment style of each fund.

Portfolio investment entity (PIE) funds are managed funds that have special lower tax rates. When you invest in a PIE, the tax on the income from your investment will be based on your prescribed investor rate (PIR).

The PIR is worked out on your taxable income in the last two tax years and may be lower than your top tax rate. For example, if your top tax rate is normally 33%, you will only pay 28% on your income from a PIE fund.

Inland Revenue’s website has more detailed information about PIEs and PIRs.

It’s a good idea. Here is some support from Inland Revenue so you can confirm yours with your fund manager. No sense paying more tax than you’re meant to, since it will only eat into your returns.

A fund manager is a professional individual or organisation who looks after some or all of a fund’s investments on behalf of many investors. They’re also called an investment manager.

Their duties include implementing the fund’s investment strategy and managing the trading activities of the portfolio. Together with analysts and traders, they determine the best shares, bonds or other investments that fit the strategy, then buy and sell them on behalf of the investors. Managers can be more active or passive in the way they operate the fund. They also prepare reports on how the fund has performed and other key information.

Each fund manager has a supervisor, which is a separate company that oversees and ensures that managers are doing what they say they will do with investors’ money.

Use verification code from your authenticator app. How to use authenticator apps.

Don't have an account? Sign up

Or log in with our social media platforms

A free account gives you your very own space where you can save your tools and track your progress as you get ahead.

Or sign up using Google: