KiwiSaver is a voluntary savings scheme set up by the government to help New Zealanders to save for their retirement.

It's an easy and affordable way to save and invest for our retirement years. Most of us can benefit from joining KiwiSaver, if we haven’t already.

Employees can choose to contribute at least 3% (which is lifting to 3.5% in April 2026 and 4% in April 2028) of your gross (before tax) wage or salary to your KiwiSaver account. Or Or you can select 4%, 6%, 8% or even 10%.

Employers are required to contribute close to 3% of your gross salary if you contribute (also lifting to 3.5% in April 2026 and 4% in April 2028).

There’s an annual government contribution as well, even if you're not an employee – as much as $260 each year until you're 65.

Your savings are invested on your behalf by the KiwiSaver provider of your choice. If you don’t choose a provider, Inland Revenue will assign you to a default KiwiSaver fund that can be a good solution for you.

How does KiwiSaver work?

A KiwiSaver fund is more than just a savings account. It's similar to what we call a managed fund. Your fund manager invests your KiwiSaver savings on your behalf, which means your savings also earn returns over time.

Your KiwiSaver grows with:

- Your automatic contributions

- Employer contributions of close to 3% on top of your pay

- Government contributions (up to $260 every year!)

- Investment returns from all the contributions being invested for you by your KiwiSaver provider

- Any additional money you choose to put in. You can make voluntary contributions – lump sums or regular automatic payments – at any time, either directly to your KiwiSaver provider or through Inland Revenue.

If you’re 18 or over and start a new job you’ll be automatically enrolled in KiwiSaver (with some exceptions). And that’s typically a good thing!

You can use KiwiSaver to save for a first home

When buying your first home you may be able to make a one-off withdrawal of most of your KiwiSaver savings – as long as you’ve been a KiwiSaver member for at least three years. You also may even qualify if you have owned property previously.

Our KiwiSaver calculator can help you find out how much you're on track to save for your first home.

Visit the Kāinga Ora website for more information on using KiwiSaver for a first home.

You can use KiwiSaver to save for retirement

If using KiwiSaver to save for retirement, you can’t touch your money until the age you get New Zealand Superannuation (NZ Super) which is currently 65. Note that KiwiSaver is open to those over 65 to join as well.

Find out how much you're on track to save for your retirement using the KiwiSaver calculator.

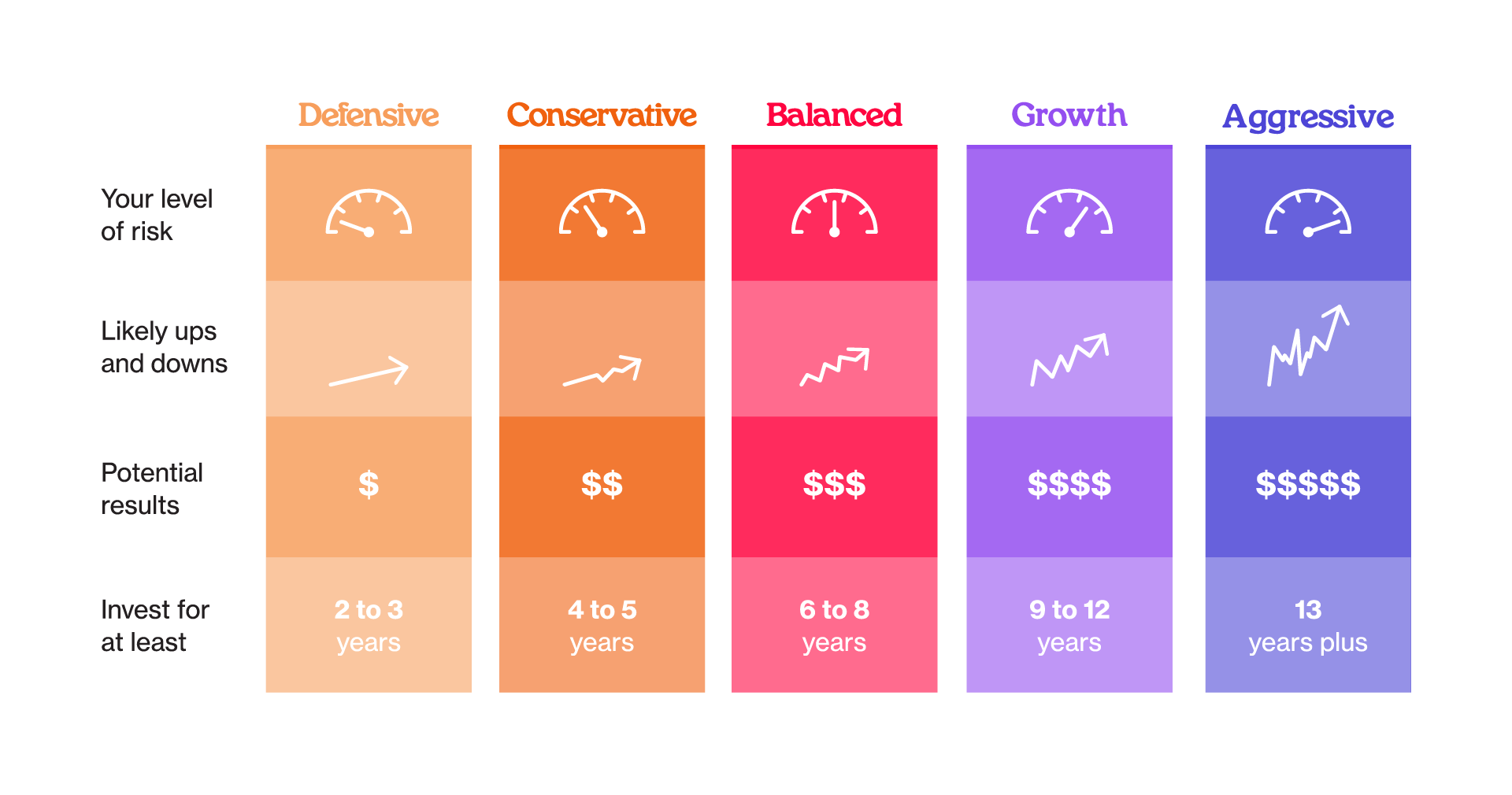

KiwiSaver funds come in five basic types

We’ve grouped the hundreds of KiwiSaver funds into five types to make things easier. Once you find which is right for you, it’s much simpler to find a fund of that type.

Each fund holds a mix of investments, and which type they fit into is based on how much of the more risky stuff, like shares and commercial property, is in the mix. The more risk you take on, the more potential you have for better results, but your balance will have more ups and downs along the way.

Depending on how long you are investing for, and your attitude towards the ups and downs that can happen with investing, one type of fund will work particularly well for your situation.

When it’s time to withdraw your money

After you reach 65, you become eligible to take all or some of your contributions, your employer’s contributions, the government's contributions, plus returns. In short, the whole thing.

How fast you open the tap is up to you: keep it off for now and leave your money invested in KiwiSaver or open it slightly to drip-feed some income. Our retirement navigator can help you chart your spending.

There’s no rush – you can leave your money where it is while you work through all the issues and decide. For example, if you want to make regular withdrawals, there may be a minimum amount required or some fees.

It may be worth talking with a financial adviser about your financial needs and risks, and work out the best course of action to reach your goals. Find out how to find a financial adviser in our guide.

Contact your KiwiSaver provider directly to find out what’s involved and to make arrangements.

What if I’m still working?

You can still keep your KiwiSaver account open and growing. Your employer can choose to keep contributing, although they don’t have to. The government will no longer pay its contribution though, since you're typically eligible for NZ Super.

Why you want to take advantage of KiwiSaver

The question of KiwiSaver is less ‘why’ and more ‘why not?’ – because of the benefits it offers.

- KiwiSaver contributions come out of your pay before you see it. This makes saving easy.

- If employed, your employer has to contribute at least 3% of your gross wage or salary into your KiwiSaver account. That’s on top of your own contributions.

- The government pays into your KiwiSaver account as well – an annual government contribution (if you are a contributing member aged 18 or over) of up to $260.

- As well as saving for retirement, you can also use KiwiSaver for buying your first home through a KiwiSaver first-home withdrawal.

- If you change jobs or leave the workforce your KiwiSaver account moves with you.

- If you experience hardship it is possible to access the funds in your account early.

- It is generally a lower-cost option to invest in managed funds.

KiwiSaver FAQs

Who can join KiwiSaver?

To be able to join KiwiSaver you don’t have to be employed, but you do have to be:

-

A New Zealand citizen, or entitled to live in New Zealand indefinitely.

-

Living or normally living in New Zealand.

Find out more about who can and can't join KiwiSaver on the Inland Revenue KiwiSaver website.

How can I join KiwiSaver?

There are three ways to join KiwiSaver:

- Automatic enrolment when starting a new job

- Opting in through your employer

- Opting in through a KiwiSaver provider

Self-employed? Not currently working? Not a problem – just contact a KiwiSaver provider to sign up and arrange a regular contribution amount. For a list of KiwiSaver providers, see the Inland Revenue KiwiSaver website.

Also, find out more about how to join KiwiSaver on the Inland Revenue website.

Is it bad to be in a KiwiSaver default fund?

No, not necessarily. They exclude investments in fossil fuels and illegal weapons, cost significantly less than other funds, have a balanced investment mix, and offer a high level of service to their members. But since balanced funds are not right for everyone, default funds won't be either. To make your choice of whether to be in a default fund, first find out which type of KiwiSaver fund will work best for you.

Are KiwiSaver funds guaranteed?

KiwiSaver is not guaranteed by the government. It is, however, administered by Inland Revenue, which helps make sure it works properly, and overseen by the Financial Markets Authority, which makes sure KiwiSaver companies behave themselves and do right by you. It's important to remember that KiwiSaver providers are private companies, like any bank we use. Here are more KiwiSaver facts.

Is it hard to switch my KiwiSaver?

No, it’s easy as – about the same as switching your mobile or power provider, actually. You let your new company know you want to move to them, and they do all the work behind the scenes. There are two ways of switching with KiwiSaver: staying with your provider but moving to one of their other funds, or moving to a new provider. There are good reasons to switch, such as when you're getting closer to the time you plan to start spending your KiwiSaver money, on a first home or in retirement. But there are also bad reasons to switch, such as because you heard about some other fund doing better than yours. Here's why.

Are KiwiSaver withdrawals taxed?

No. When you take out your KiwiSaver money, either for a first home, financial hardship, or to use to live on in retirement, that money is tax-free. Your KiwiSaver contributions are made after your income has been taxed, and the gains from your investments that you own in KiwiSaver are taxed as well. But when you withdraw for a first home or retirement at age 65, there is no tax to pay. It's your money to use. To withdraw your KiwiSaver money, contact your provider directly.

What is the tax rate on KiwiSaver?

There are three prescribed investor rates (PIR) in KiwiSaver: 10.5%, 17.5%, or 28%. It helps to make sure your rate is correct so you're not paying more tax than you should be. If your income is sometimes or always less than $48,000 each year, you may be paying too much tax in KiwiSaver. It's simple to correct this: just contact your KiwiSaver provider directly and let them know.

Who gets my KiwiSaver if I die?

Your KiwiSaver money is much like everything else you own – when you die it becomes part of your estate and is distributed according to the instructions you leave in your will. It's important to have a will drawn up just in case. Without a will the government will use a set formula to split up your assets – and this might not be what you would have wanted. To make sure your wishes are followed, particularly with your KiwiSaver, here's more about wills.

Where can I go for more help?

- Inland Revenue KiwiSaver webpages: Everything there is to know about the KiwiSaver scheme

- Kāinga Ora Home Ownership webpages: Using KiwiSaver to help buy a first home

- Investment advice: KiwiSaver providers or financial advisers

- Financial Markets Authority website: KiwiSaver regulations and international transfer information

Can I opt out of KiwiSaver?

If automatically enrolled, you can ‘opt out’ (leave KiwiSaver), but only between 2 and 8 weeks of starting a job. Once you join you have to contribute for at least 12 months. (If you’re 18 or younger and have been incorrectly enrolled, you can still opt out through Inland Revenue.)

You can choose to ‘opt in’ (join KiwiSaver) at any time – although once you do, you can't opt out –either through your employer or through a KiwiSaver provider.

You may also like...

Verify with authenticator app

Use verification code from your authenticator app. How to use authenticator apps.

Enter 6-digit code

Log in to your account

Don't have an account? Sign up

Or log in with our social media platforms

Create your Sorted account

A free account gives you your very own space where you can save your tools and track your progress as you get ahead.

Or sign up using Google: