KiwiSaver

Planning & budgeting

Saving & investing

KiwiSaver

Tackling debt

Protecting wealth

Retirement

Home buying

Life events

Setting goals

Money tracking

Plan your spending with a budget

Getting advice

Studying

Get better with money

What pūtea beliefs do you have?

How to save your money

How to start investing

Find a financial adviser to help you invest

Your investment profile

Compound interest

Net worth

Types of investments

Term deposits

Bonds

Investment funds

Shares

Property investment

How KiwiSaver works and why it's worth joining

How to pick the right KiwiSaver fund

Make the most of KiwiSaver and grow your balance

How KiwiSaver can help you get into your first home

Applying for a KiwiSaver hardship withdrawal

How to use buy now pay later

Before borrowing

How to get out of debt quickly

Credit reports

Know your rights

Pros and cons of debt consolidation

Credit cards

Car loans

Personal loans

Hire purchase

Student loans

Getting a fine

What happens if I start to struggle with moni?

How to protect yourself from fraud and being scammed

About insurance

Insurance types

Insuring ourselves

Wills

Enduring powers of attorney

Family trusts

Insuring our homes

Losing a partner

Redundancy

Serious diagnosis

How to cope with the aftermath of fraud

Separation

About NZ Super

This year's NZ Super rates

When you’re thinking of living in a retirement village

How to plan, save and invest for retirement

Manage your money in retirement

Find housing options in retirement

Planning & budgeting

Saving & investing

KiwiSaver

Tackling debt

Protecting wealth

Retirement

Home buying

KiwiSaver

Budgeting

KiwiSaver

Budgeting

Women

Women

Women

Budgeting

Resources

Help with the cost of living

Just wondering

In need of financial help

Booklets

Glossary

Videos

Blogs

View all

26 October 2018

Reading time: 4 minutes

Posted

by

Tom Hartmann

, 1 Comments

Scammers know it. Salespeople know it. Heck, even kids know it when they’re asking you for money.

We part with our money much more easily when we’re in an emotional state.

Attempting to make good money choices in such a state is like trying to see in a sandstorm. It’s why we should never jump into a car and drive just after a heated argument. Not a good idea.

But by “emotional” I don’t just mean tears are falling or we’re head over heels in love. Here are some common scenarios:

Interviews with fraudsters have uncovered patterns of how they exploit how we’re feeling. They call it the “ether” of emotion, and when we’re under its influence, it’s easy for us to fall prey to fraud.

Turns out there are many things that can tip us into that ether, including romance, spirituality or the possibility of winning. While we’re in that state, we are more at risk than ever, and it’s no surprise that romance scams, affinity fraud and investment scams are among some of the world’s most deviously successful cons.

Then there are all the things we go through in life that can leave us feeling vulnerable. Loss of a loved one – especially a partner, child or even a pet – can put us in jeopardy. You can see why a scammer or salesperson armed with this information about us has extra leverage – almost a direct line to our bank accounts.

And nowadays, so much of what we’re going through is on display through social media. One recent scam victim had a family member say, “We’ll just get you started on Facebook” in order to help her recover from her bereavement. This good intention unfortunately made her a target.

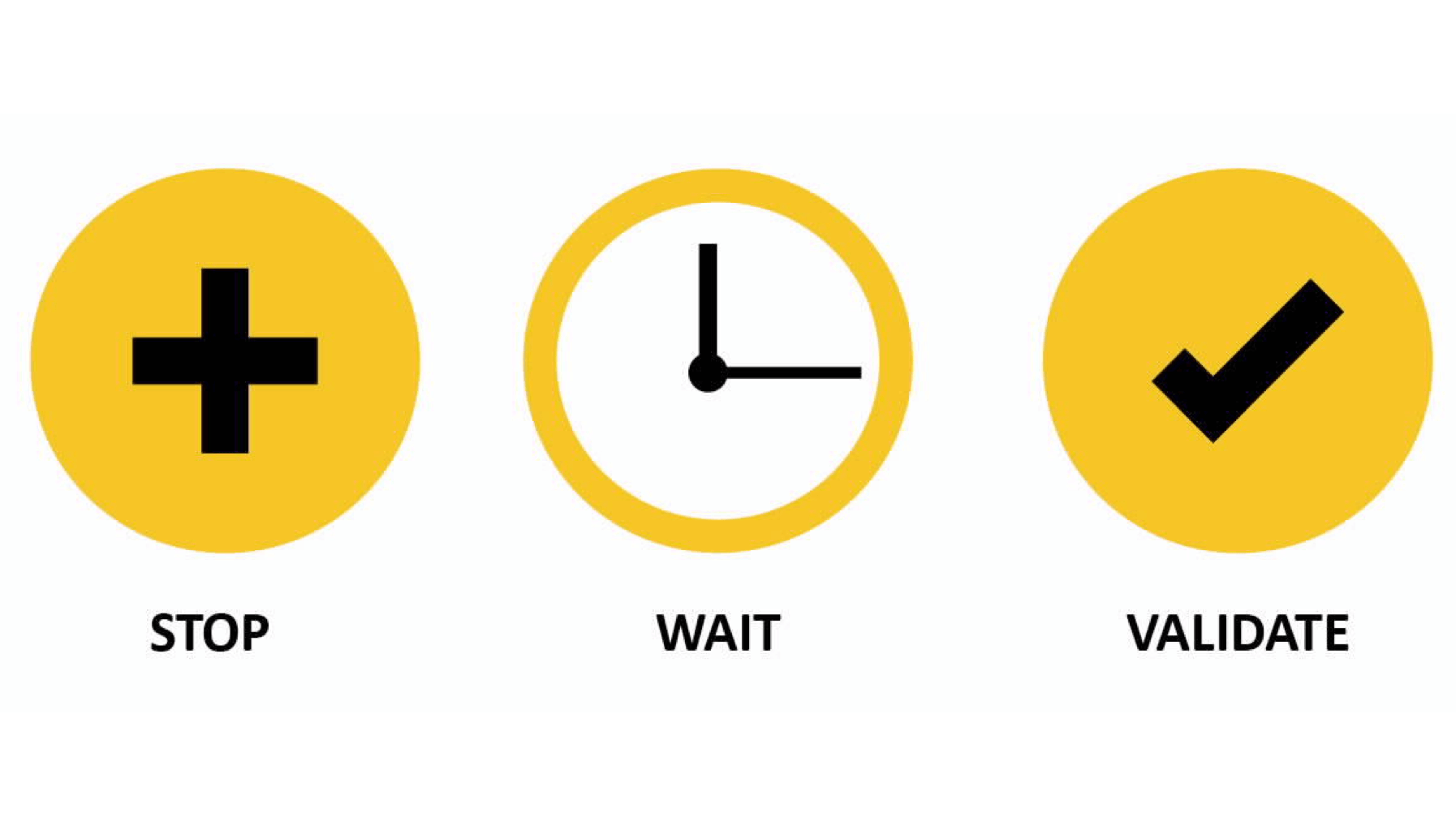

With a tip of the hat to our friends at Age Concern, who are working hard to protect our older New Zealanders, here’s a winning formula:

The “stopping” in our tracks is probably the hardest part. But if we can get to the “waiting”, it definitely works. With money matters, delaying gratification while we carefully consider our options is highly effective.

But what does “validate” mean? In terms of protecting ourselves from fraud, it’s about checking that something is for real, since so much these days is not.

When making money choices in general, “validate” means checking that it’s what we really want. It has to fit our plan for our money, both in the short and long terms. Sometimes it will, sometimes it won’t.

The obvious safety valve when we’re emotional are those we’re closest to. Who in our close circle is going through something? They’ll need support, especially if they’re making financial decisions.

Some time back I invited a friend along as I was buying a car. “I’m just coming along to watch you get ripped off,” he said dryly. That got me haggling! Strangely, I found it quite helpful.

Let’s look out for each other out there.

5 steps to get your $521

1 Comment

Who’s teaching your daughter (or niece, or granddaughter) about money?

1 Comment

My Money Sorted: Hilary Barry

2 Comments

My Money Sorted: Ben

3 Comments

My Money Sorted: Daniel

1 Comment

8 ways to hack Christmas when you’re stretching the budget

6 Comments

Use verification code from your authenticator app. How to use authenticator apps.

Code is invalid. Please try again

Don't have an account? Sign up

Or log in with our social media platforms

A Sorted account gives you a personal dashboard where you can save your tools, track your progress and you'll also receive helpful money tips and guidance straight to your inbox.

Comments (1)

Comments

24 November 18

anderson mallen

hello, i got caught up in a scam some years ago. I had thought all hope was lost. I made several payments to offshore bank accounts via credit cards to asia and north africa. I looked for help until I came across a Hacker and private investigator. He did a lot of work and helped me recover about 80% of the money back. The culprits were brought to justice in their respective countries.

No one has commented on this page yet.

RSS feed for comments on this page | RSS feed for all comments