KiwiSaver

Planning & budgeting

Saving & investing

KiwiSaver

Tackling debt

Protecting wealth

Retirement

Home buying

Life events

Setting goals

Money tracking

Plan your spending with a budget

Getting advice

Studying

Get better with money

What pūtea beliefs do you have?

How to save your money

How to start investing

Find a financial adviser to help you invest

Your investment profile

Compound interest

Net worth

Types of investments

Term deposits

Bonds

Investment funds

Shares

Property investment

How KiwiSaver works and why it's worth joining

How to pick the right KiwiSaver fund

Make the most of KiwiSaver and grow your balance

How KiwiSaver can help you get into your first home

Applying for a KiwiSaver hardship withdrawal

How to use buy now pay later

Before borrowing

How to get out of debt quickly

Credit reports

Know your rights

Pros and cons of debt consolidation

Credit cards

Car loans

Personal loans

Hire purchase

Student loans

Getting a fine

What happens if I start to struggle with moni?

How to protect yourself from fraud and being scammed

About insurance

Insurance types

Insuring ourselves

Wills

Enduring powers of attorney

Family trusts

Insuring our homes

Losing a partner

Redundancy

Serious diagnosis

How to cope with the aftermath of fraud

Separation

About NZ Super

This year's NZ Super rates

When you’re thinking of living in a retirement village

How to plan, save and invest for retirement

Manage your money in retirement

Find housing options in retirement

Planning & budgeting

Saving & investing

KiwiSaver

Tackling debt

Protecting wealth

Retirement

Home buying

KiwiSaver

Budgeting

KiwiSaver

Budgeting

Women

Women

Women

Budgeting

Resources

Help with the cost of living

Just wondering

In need of financial help

Booklets

Glossary

Videos

Blogs

View all

13 February 2020

Reading time: 5 minutes

Posted

by

Tom Hartmann

, 0 Comments

So climate’s on your mind, and you’re committed to being a part of the solution. You’re buying locally, eating flexitarian, driving and flying less, probably even been marching on Fridays.

Did you know your KiwiSaver choices can follow your heart, too? The fund you choose not only can match your values, it can even help cool the planet.

There are many innovative efforts these days to reverse global warming and even draw down the amount of harmful gases we’ve released into the atmosphere. Many solutions will need to come from companies.

That takes investment. And that’s what KiwiSaver’s about.

Many people don’t realise this, thinking they’re just saving for retirement or for a first home. But as we funnel money into a fund, it’s being invested for us – often in shares of companies, or bonds that can actually be loans to those companies.

Which companies? What industries? It’s good to know where our money is flowing. Just as we make ethical choices on what we consume – superfoods, healthy snacks, sustainable beauty products – we can also make choices when we buy into some investments and not others.

But before we jump down that rabbit hole and look at which investments are “ethical” and which are not, we need to take a couple of important steps:

There’s no point being in the most ethical KiwiSaver fund in the world but it being the wrong type of fund for your needs. You may as well not be in KiwiSaver at all and do something else with your money (but then you’d miss out on all the KiwiSaver advantages).

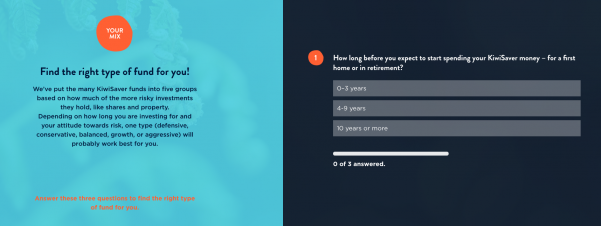

There are hundreds of KiwiSaver funds out there, which tend to be grouped into five types, based on the proportion of risky investments they hold:

(‘Aggressive’ is not about your personality, but rather because these funds hold the most risky investments like shares and commercial property.)

Even if you think you’re in the right type of fund for you, circumstances change, so it pays to double check every now and then. Here are three questions to help:

You may have already chosen a fund, or the government may have effectively selected one for you when you were opted into a KiwiSaver “default” fund.

But now that you know your type, does your current fund match? If your type is “growth”, are you in a growth fund? If not, it’s time to find one.

In KiwiSaver, everyone needs to actively choose which fund they’re in – especially if they want it to match their values and not keep heating up the globe.

You may have already been to Sorted’s Smart Investor – where you can browse through funds by type. Inside each fund is a mix of investments. You can also compare the fees they charge (that’s the amount we pay the fund manager to invest our money). In short, you can check all the top information about a fund that’s available.

At this stage we need to look at what’s inside each fund to see whether the investments are climate friendly.

You could have another look at Smart Investor – it’s the first tool that enables you to see the entire list of every investment in each fund. That’s especially good if you want to geek-out on all the information, but happily there is also a simpler way.

Websites such as Mindful Money make it transparent – you can easily see whether the fund you’re thinking of choosing holds investments that are climate challenged, and check other ethical considerations you may have as well. Check to see what’s inside your fund here.

It’s one thing to make sure your fund doesn’t have anything nasty or controversial in it – it’s quite another to choose a fund that has specific ethical goals. Here’s a short list, once again organised by fund type:

AMP Responsible Investment Balanced Fund

Booster Socially Responsible Investment Balanced Fund

Craigs Investment Partners Quaystreet Balanced SRI Fund

Booster Socially Responsible Investment High Growth Fund

ANZ Sustainable International Share Fund

In the rush to save the planet, there's no point running to a fund that isn’t the right type for you. You could miss out on tens of thousands of dollars if you’ve got the wrong type for your situation. Sort that first, then find your ethical match.

Happy picking!

5 steps to get your $521

1 Comment

Who’s teaching your daughter (or niece, or granddaughter) about money?

1 Comment

My Money Sorted: Hilary Barry

2 Comments

My Money Sorted: Ben

3 Comments

My Money Sorted: Daniel

1 Comment

8 ways to hack Christmas when you’re stretching the budget

6 Comments

Use verification code from your authenticator app. How to use authenticator apps.

Code is invalid. Please try again

Don't have an account? Sign up

Or log in with our social media platforms

A Sorted account gives you a personal dashboard where you can save your tools, track your progress and you'll also receive helpful money tips and guidance straight to your inbox.

Comments (0)

Comments

No one has commented on this page yet.

RSS feed for comments on this page | RSS feed for all comments