Planning & budgeting

Saving & investing

KiwiSaver

Tackling debt

Protecting wealth

Retirement

Home buying

Life events

Setting goals

Money tracking

Plan your spending with a budget

Getting advice

Studying

Get better with money

What pūtea beliefs do you have?

How to build up your emergency savings to cover unexpected costs

How to save your money

How to start investing

Find a financial adviser to help you invest

Your investment profile

Compound interest

Net worth

Types of investments

Term deposits

Bonds

Investment funds

Shares

Property investment

How KiwiSaver works and why it's worth joining

How to pick the right KiwiSaver fund

Make the most of KiwiSaver and grow your balance

How KiwiSaver can help you get into your first home

Applying for a KiwiSaver hardship withdrawal

How to use buy now pay later

What you really need to know before you use credit

How to get out of debt quickly

Credit reports

Know your rights

Pros and cons of debt consolidation

Credit cards

Car loans

Personal loans

Hire purchase

Student loans

Getting a fine

What happens if I start to struggle with moni?

How to protect yourself from fraud and being scammed

About insurance

Insurance types

Insuring ourselves

Wills

Enduring powers of attorney

Family trusts

Insuring our homes

Losing a partner

Redundancy

Serious diagnosis

How to cope with the aftermath of fraud

Separation

About NZ Super – how much is it?

When you’re thinking of living in a retirement village

How to plan, save and invest for retirement

Manage your money in retirement

Find housing options in retirement

Four approaches to spending in retirement

Planning & budgeting

Saving & investing

How to build up your emergency savings to cover unexpected costs

How to save your money

How to start investing

Find a financial adviser to help you invest

Your investment profile

Compound interest

Net worth

Types of investments

Term deposits

Bonds

Investment funds

Shares

Property investment

View all

KiwiSaver

Tackling debt

How to use buy now pay later

What you really need to know before you use credit

How to get out of debt quickly

Credit reports

Know your rights

Pros and cons of debt consolidation

Credit cards

Car loans

Personal loans

Hire purchase

Student loans

Getting a fine

What happens if I start to struggle with moni?

View all

Protecting wealth

Retirement

Home buying

Reading time: 6 minutes

You can take NZ Super into account when you're planning for retirement. The current rates below give a broad idea of how much it is this year. Could you live on that? If not, it’s time to put some other plans in place to bridge the gap between what it provides and what you’ll need to fund your lifestyle after stepping back from paid work.

Here are the current superannuation rates after tax has been deducted at rate 'M' (the standard code if NZ Super is your primary income). For other tax codes, see the Work and Income website.

|

Standard NZ Super rates (after tax, code M) |

|||

|

Qualifying as |

Weekly |

Fortnightly |

Annually |

|

Single: living alone |

$538 |

$1043 |

$27,998 |

|

Single: sharing |

$497 |

$963 |

$25,844 |

|

Married, civil union or de facto couple: one partner qualifies and the other is not included (ie, you’re 65+ and qualify, but your partner is under 65 or doesn’t meet the requirements and doesn’t need financial support from your NZ Super) |

$414 |

$803 |

$21,537 |

|

Married, civil union or de facto couple: both partners qualify (ie, both of you are 65+, either citizens or residents, and meet residency rules) |

$828 |

$1607 |

$43,074 |

|

Married, civil union or de facto couple: one partner qualifies and the other is included (ie, you’re 65+ and qualify, and your partner doesn’t qualify but depends on your NZ Super) |

$788 |

$1528 |

$40,954 |

Source: Ministry of Social Development

The level of NZ Super payments is set by the government each year, which reviews and adjusts them to take into account any increases in the cost of living (inflation) and average wages.

The after-tax NZ Super rate for couples (who both qualify) is based on 66% of the ‘average ordinary time wage’ after tax. For single people, the after-tax NZ superannuation rate is close to 40% of that average wage.

NZ Super is paid fortnightly every second Tuesday. If that falls on a holiday, the payment is processed earlier. Here’s where to see the dates.

If you have income from another source (if you’re still working or earn investment income), your after-tax amount of NZ Super may differ. You can find out exactly what you’re entitled to from Work and Income by calling 0800 552 002 (you’ll need to have your IRD number handy) or their website. See Inland Revenue’s website for more information as well.

All eligible New Zealanders receive NZ Super, regardless of how much they:

To be eligible for NZ Super, you need to be aged 65 or over and a legal resident of New Zealand. You can get NZ Super even if you’re still working.

Currently, you need to have lived here for 10 years since age 20. Since July 2024, however, this residency requirement has been gradually increasing to 20 years by July 2042.

You’ll need to have lived in New Zealand, the Cook Islands, Niue or Tokelau (or a combination of these) for 20 years since age 20, with five of those years from age 50 or older.

To have lived in New Zealand means you were both a resident and physically present in the country at the same time.

Being resident means you permanently made your home in New Zealand for the required number of years.

For example, if someone usually lives overseas, but visits New Zealand from time to time, those visits do not count as time in which they are resident and present, because they’re not permanently making their home here.

You will need to be physically in New Zealand for the required number of years. If you left, you weren't physically present in New Zealand for that time period.

For example, if someone usually lives in New Zealand but takes overseas holidays, those holidays do not count as time in which they are resident and present (even if they are employed and paying tax in New Zealand), because they are not physically here.

Here’s more information on the change to the residency requirement.

Here’s more information about NZ Super eligibility.

It’s important to remember that NZ Super may be different in years to come in terms of who gets it and when.

If you receive a pension from another country (such as UK state pension, Australian Age Pension, or similar), this may reduce your NZ Super payment by the amount you receive from overseas.

For more information, call Work and Income on 0800 777 227 or email international.services@msd.govt.nz.

If you’re eligible, you can apply for NZ Super three months before you turn 65. There’s a form on the Work and Income website, or Work and Income can be reached on 0800 552 002.

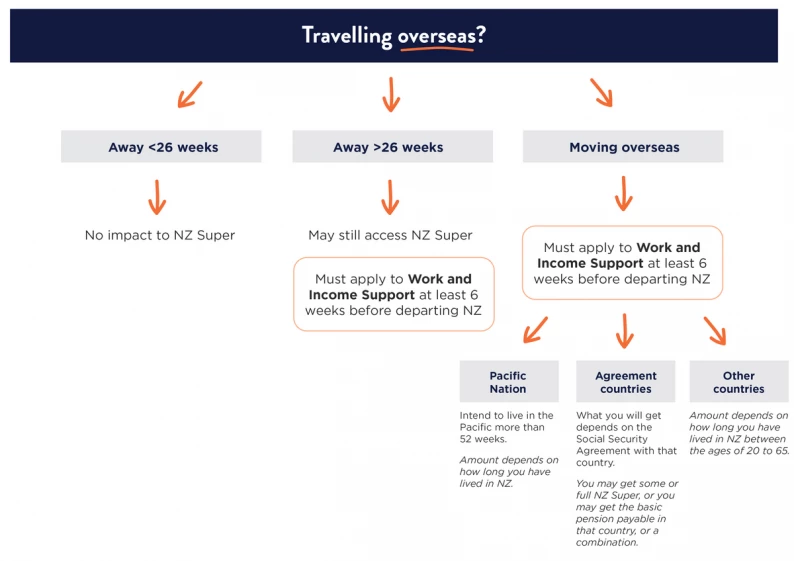

Probably. Being away from New Zealand for less than 26 weeks is generally fine. If you’re away for longer than that or you’re moving away permanently, the amount you receive could be less than you would get if you stayed in New Zealand, and will depend on which country you’re in.

You should consider taking advice from Work and Income’s International Services before making decisions, particularly if NZ Super is a big part of your retirement income.

For more details on receiving NZ Super while travelling or moving overseas, see this Te Ara Ahunga Ora Retirement Commission document and the Work and Income website.

NZ Super is generous by international standards, but it only goes so far. Many of us will have a gap between what it provides and the retirement lifestyle we’re hoping to achieve.

To understand how much your gap might be, you can plug your numbers into our retirement calculator.

Guide

Ask anyone who's retired, and they will say to start saving for retirement as soon as you can! Even if…

Guide

Moving into a retirement village can be a great option to live out your later years. But with so many…

Guide

Discover four expert-backed rules of thumb for retirement spending that help balance enjoyment and security.

Guide

As you get older and your needs change, where you decide to live can shift as well. Knowing your options…

Guide

Life after you stop working can mean living without a steady income, so you’ll have some choices to make. This…

Video

Navigating the financial and legal aspects of moving into a retirement village can feel daunting, but if you get good…

Video

Buying into a retirement village isn’t an investment, it’s an expense. For a smooth transition and a financially secure future,…

Video

Moving into a retirement village is a big decision, so it’s important to be clear about your circumstances and lifestyle…

Use verification code from your authenticator app. How to use authenticator apps.

Code is invalid. Please try again

Don't have an account? Sign up

Or log in with our social media platforms

A free account gives you your very own space where you can save your tools and track your progress as you get ahead.

Or sign up using Google: